Nice little shell game you've come up with, but it Epically FAILS.

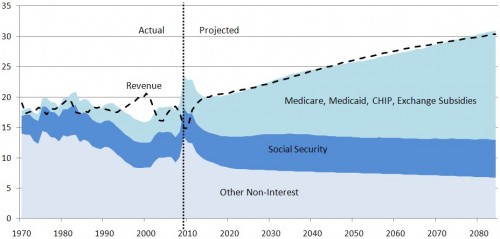

You can't judge taxation based on GDP, most people don't even understand GDP. You can make a really neat (but irrelevant) chart, and it looks like Americans are getting off easy on taxes... but your chart fails to recognize our GDP is mammoth compared to most other countries. In fact, I am kinda surprised we aren't at the very bottom of the list, if that is the criteria you are using.

AND When the hell did this mindset develop, that we must constantly be comparing ourselves with other countries around the world? I don't give a shit how much tax someone pays in Venezuela! It makes NO difference to me, and it makes NO difference to my country! I don't care that America is not like France! I don't want to be like France! This is the United States of America, founded on principles of freedom and liberty for all, and the greatest liberating force ever known to mankind.