The longest job-creation streak in modern U.S. history continues despite the recent government shutdown.

Businesses created 304,000 jobs in January, the Labor Department said on Friday. That number blew away expectations of many economists, who had predicted that about 165,000 jobs would be added in the first month of the year. The transportation, leisure and hospitality, construction, and health care industries led the job gains.

The unemployment rate rose slightly, to 4 percent from 3.9 percent, nudged up by the 35-day partial government shutdown that ended last month. It's the second straight month the unemployment rate has increased, but economists say it's for the right reason: More people are coming off the sidelines and looking for work.

Furloughed federal workers were counted as employed in the report, the government said.

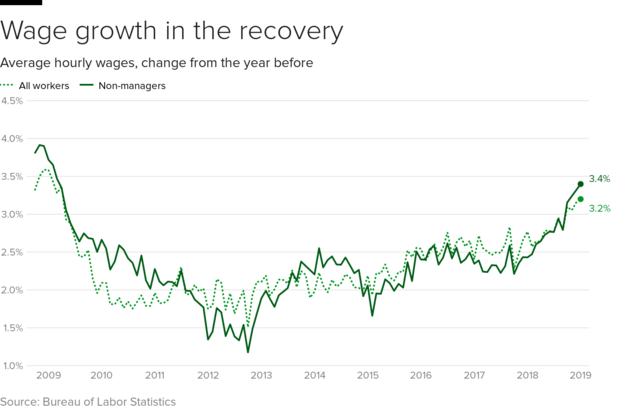

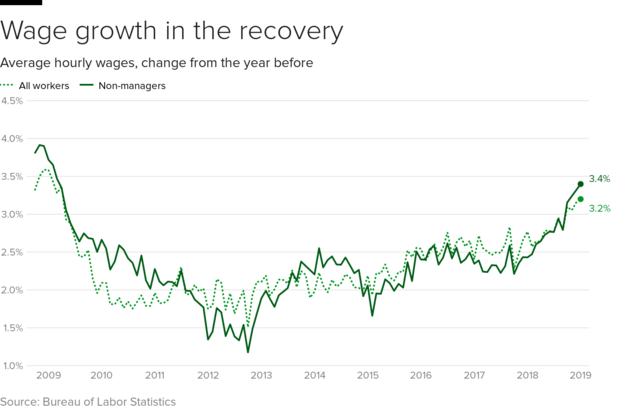

Average workers' wages kept growing, with hourly earnings for non-managers rising 3.4 percent from the year before. That represents the fastest pace for wage growth in nearly a decade. Average earnings for all workers grew slightly slower than in December, at 3.2 percent.

Economists say the latest job numbers point to the economy's underlying strength. "January's strong performance quells any lingering feelings that a hiring plateau might have occurred from tariffs, the government shutdown or recent market volatility," Steve Rick, chief economist at CUNA Mutual Group, said in a note.

Do strong jobs numbers mean inflation is coming? The jury's still out. January's report "might make one worried about inflation, but, on the other hand, the continued increase in participation should lead the Fed to realize that we're not yet at a point where we'll cause the economy to overheat," said Julia Pollak, chief economist at the hiring site ZipRecruiter.

After hiking interest rates four times last year, the Federal Reserve signaled this week that it would pause following several months of stock market volatility and signs of slowing global growth.

Businesses created 304,000 jobs in January, the Labor Department said on Friday. That number blew away expectations of many economists, who had predicted that about 165,000 jobs would be added in the first month of the year. The transportation, leisure and hospitality, construction, and health care industries led the job gains.

The unemployment rate rose slightly, to 4 percent from 3.9 percent, nudged up by the 35-day partial government shutdown that ended last month. It's the second straight month the unemployment rate has increased, but economists say it's for the right reason: More people are coming off the sidelines and looking for work.

Jim Baird, partner and chief investment officer for Plante Moran Financial Advisors, said in a note."It's the very strength of that economy and the abundance of job openings that is pulling more individuals back into the labor force,"

Furloughed federal workers were counted as employed in the report, the government said.

Average workers' wages kept growing, with hourly earnings for non-managers rising 3.4 percent from the year before. That represents the fastest pace for wage growth in nearly a decade. Average earnings for all workers grew slightly slower than in December, at 3.2 percent.

Economists say the latest job numbers point to the economy's underlying strength. "January's strong performance quells any lingering feelings that a hiring plateau might have occurred from tariffs, the government shutdown or recent market volatility," Steve Rick, chief economist at CUNA Mutual Group, said in a note.

Do strong jobs numbers mean inflation is coming? The jury's still out. January's report "might make one worried about inflation, but, on the other hand, the continued increase in participation should lead the Fed to realize that we're not yet at a point where we'll cause the economy to overheat," said Julia Pollak, chief economist at the hiring site ZipRecruiter.

After hiking interest rates four times last year, the Federal Reserve signaled this week that it would pause following several months of stock market volatility and signs of slowing global growth.