To me, taxes has become the kind of issue for the left that environmentalism has become for the right.

On the latter, even many reasonable righties oppose common sense green measures as a knee-jerk; it's just seen as a "leftie" cause, and they don't want any part of it. In some ways, they have helped to define the GOP as being somewhat anti-planet.

By the same token, those on the left have heard for so long that the the right is "anti-tax," they almost feel like they're SUPPOSED to be the party/side of higher taxes.

It's madness. I know I'll get lambasted for this, but anyone who doesn't think we're way overtaxed, and who thinks that the tax climate for American business is good & competitive, is just not thinking in the here & now. We're pretty much taxed to oblivion, and our gov't spends too much.

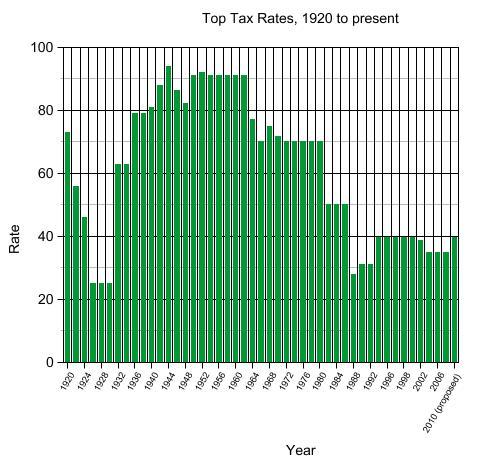

I don't think that's really a fair assessment. What is aggravating is that even though our taxation system is at historically low levels for the wealthy and is becoming more and more regressive while at the same time income disparities are becoming larger and larger we here the same old lame shit from those of the far right.

We have a budget deficit, how do we fix it? "Tax cuts for the wealthy"

We are in a recession, how do we stimulate the economy? "Tax cuts for the wealthy"

Unemployment is high, how to we stimulate jobs growth? "Tax cuts for the wealthy"

We have a huge trade deficit, how do we balance it? "tax cuts for the wealthy"

Aunt Petunia has inflammed hemaroids, how do we cure them? "tax cuts for the wealthy"

It's become a brain dead religious mantra from the right, particularly in the light of the evidence from nearly 30 years of regressive tax cuts for higher income Americans that the tax cuts have not accomplished what they have claimed they would. What they have done is created a huge income disparity between the mega wealthy and the working classes who struggle to maintain a middle class life style and combined with the grossly irresponsible military spending, have created a vast amount of public debt.

Now I'm no partisan democrat but between the blatant economic class warfare of the right wing combined with it's alliance to brain dead reactionary social conservatives I'm not only convinced that the Republican party is incapable of governing affectively but does so dangerously.

Now that doesn't mean I'm giving welfare state liberals of the Demoractic party a pass. Fuck them, they need to get their hands out of my pockets.

But that doesn't change the fact at how appalled I am at the cancer that is destroying the Republican party.