Mott the Hoople

Sweet Jane

While it is indeed a PART of the decision making process, the part he fails to comprehend is all other parts being equal (meaning they remain the same regardless of income tax rates) higher taxes mean LESS money the business owner has to pay in terms of salary etc...

He also ignores the fact that the benefits of an employee are not normally immediate to the company bottom line because of the learning curve of the job. This is not always the case, but most times the new employee is not going to be as productive as one with experience.

When you factor in the uncertainty, a small business owner presented with the fact that they may pay higher taxes in the future will typically hold off on hiring until the uncertainty becomes clear. Given that any freshman taking Econ 101 can tell you that raising taxes in a recessionary environment will retard growth of the economy, most business owners (small and large) will put a halt on hiring due to the expense of training and more importantly the expense of firing an employee.

So if a business owner knows:

1) Hiring a new employee will require training to get that employee up to speed

2) Taxes are going up

3) Tax increases retard growth

4) retarded growth could impact his/her bottom line

5) lower bottom line means potential layoffs

6) firing employee is expensive

then that business owner is NOT going to be hiring in the above environment

Dude you're rationalizing and the proposed tax increase is such a small cost to doing business that if it had any of the impacts you listed then somebody doesn't know how to run a business. It's that plain and simple.

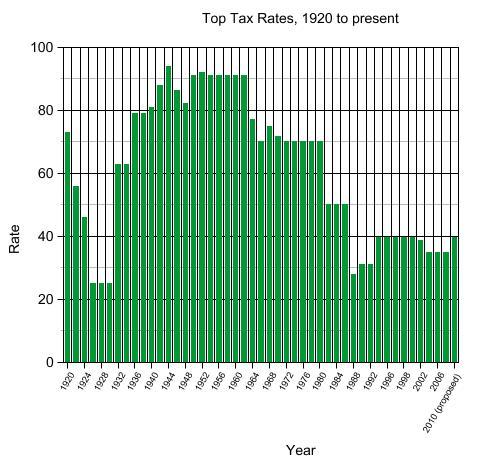

If the Obama middle class tax cuts are implemented the over whelming majority of smal business would not generate enough profits to fall into the upper two tax brackets which would only see a 4% raise in taxes (still hisorically low levels at that). Using Apples example of a small business with a $5000 tax burden that's a net increase in cost of $200 fucking dollars. When all the other costs of running that business are added up it doesn't even add up to 1% increase in their cost of doing business.

On the other hand progressive tax cuts alway provide a far greater stimulus the regressive tax cuts. That's because the middle class people and small businesses who will recieve those cuts will spend that money and it is spending that drives our economy and not tax cuts. Maintaining the regressive high end tax cuts for the top 2 to 5% of earners via the Bush tax cuts would not have nearly the economic stimulus because most of that money will not be spent. It will remain in the hands of that top 2 to 5% causing less economic growth and greater income disparity.

The Obama middle class tax cuts have been supported by both mainstream economist and the CBO has having a far greater economic stimulus then maintaining the regressive Bush tax cuts for the wealthy.