Compare the Dixie dunce's dreamworld with the facts....

The last true "tax cut" we had was 2003, when Bush lowered them to near what they previously were, before Bill Clinton raised them.

In 1981,

Congress enacted the largest tax cut in U.S. history, approximately $750 billion over six years.

The tax reduction, however, was partially offset by two tax acts, in 1982 and 1984, that attempted to raise approximately $265 billion.

On Oct. 22, 1986, President Reagan signed into law the Tax Reform Act of 1986, one of the most far-reaching reforms of the United States tax system since the adoption of the income tax.

The top tax rate on individual income was lowered from 50% to 28%, the lowest it had been since 1916.

Tax preferences were eliminated to make up most of the revenue.

In an attempt to remain revenue neutral, the act called for a $120 billion increase in business taxation and a corresponding decrease in individual taxation over a five-year period.

Following what seemed to be a yearly tradition of new tax acts that began in 1986, the Revenue Reconciliation Act of 1990 was signed into law on Nov. 5, 1990.

As with the '87, '88, and '89 acts, the 1990 act, while providing a number of substantive provisions, was small in comparison with the 1986 act. The emphasis of the 1990 act was increased taxes on the wealthy.

The last time someone significantly reduced our tax rates, it was Ronald Reagan.

President George W. Bush signed a series of tax cuts into law.

The largest was the Economic Growth and Tax Relief Reconciliation Act of 2001.

It was estimated to save taxpayers $1.3 trillion over ten years, making it the third largest tax cut since World War II.

The Bush tax cut created a new lowest rate, 10% for the first several thousand dollars earned.

It also established a slow schedule of incremental tax cuts that would eventually double the child tax credit from $500 to $1,000, adjust brackets so that middle-income couples owed the same tax as comparable singles, cut the top four tax rates (28% to 25%; 31% to 28%; 36% to 33%; and 39.6% to 35%).

The Jobs and Growth Tax Relief and Reconciliation Act of 2003 accelerated the tax rate cuts that had been enacted in 2001, and temporarily reduced the tax rate on capital gains and dividends to 15%.

In 2004, the U.S. was forced to eliminate a corporate tax provision that had been ruled illegal by the World Trade Organization.

Along with that tax hike, Congress passed a cornucopia of tax breaks, which for individuals included an option to deduct the payment of whichever state taxes were higher, sales or income taxes.

Two tax bills signed in 2005 and 2006 extended through 2010 the favorable rates on capital gains and dividends that had been enacted in 2003, raised the exemption levels for the Alternative Minimum Tax, and enacted new tax incentives designed to persuade individuals to save more for retirement.

Go back and look at how many jobs were created, following the Reagan-era tax cuts.

Job growth under the Reagan administration was an average of 2.1% per year, with unemployment averaging 7.5%...

http://en.wikipedia.org/wiki/Reaganomics#Results

You can't ARGUE about tax cuts for 10 years, and renew tax cuts already in place, then claim you have been cutting taxes for years.

Who said anyone had been cutting taxes for years?

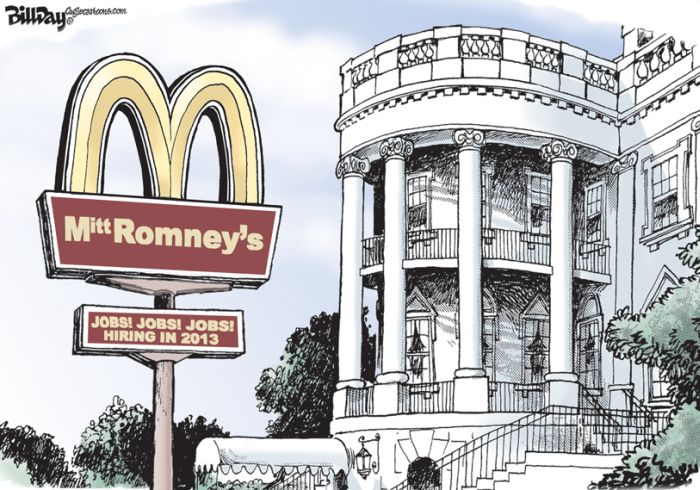

We've renewed the Bush tax cuts...where are the jobs?