Yes, we definitely need massive cuts to the defense budget, as much as RWers really, really love bombs and missiles and jets and wars. Think of all the nice things we could afford: cheaper or free higher education. National health care plan for all. Better infrastructure. Plenty for scientific and medical R&D. Help with daycare costs. We could join the rest of the civilized world by using our citizens' taxes to benefit them rather than benefit the military-industrial complex.I am from the school of we cannot afford to keep paying for things beyond our means even if you really really like them.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tuition Increases and Layoffs Are Coming to a Broad Set of Universities

- Thread starter Hume

- Start date

Yes, we definitely need massive cuts to the defense budget, as much as RWers really, really love bombs and missiles and jets and wars. Think of all the nice things we could afford: cheaper or free higher education. National health care plan for all. Better infrastructure. Plenty for scientific and medical R&D. Help with daycare costs. We could join the rest of the civilized world by using our citizens' taxes to benefit them rather than benefit the military-industrial complex.

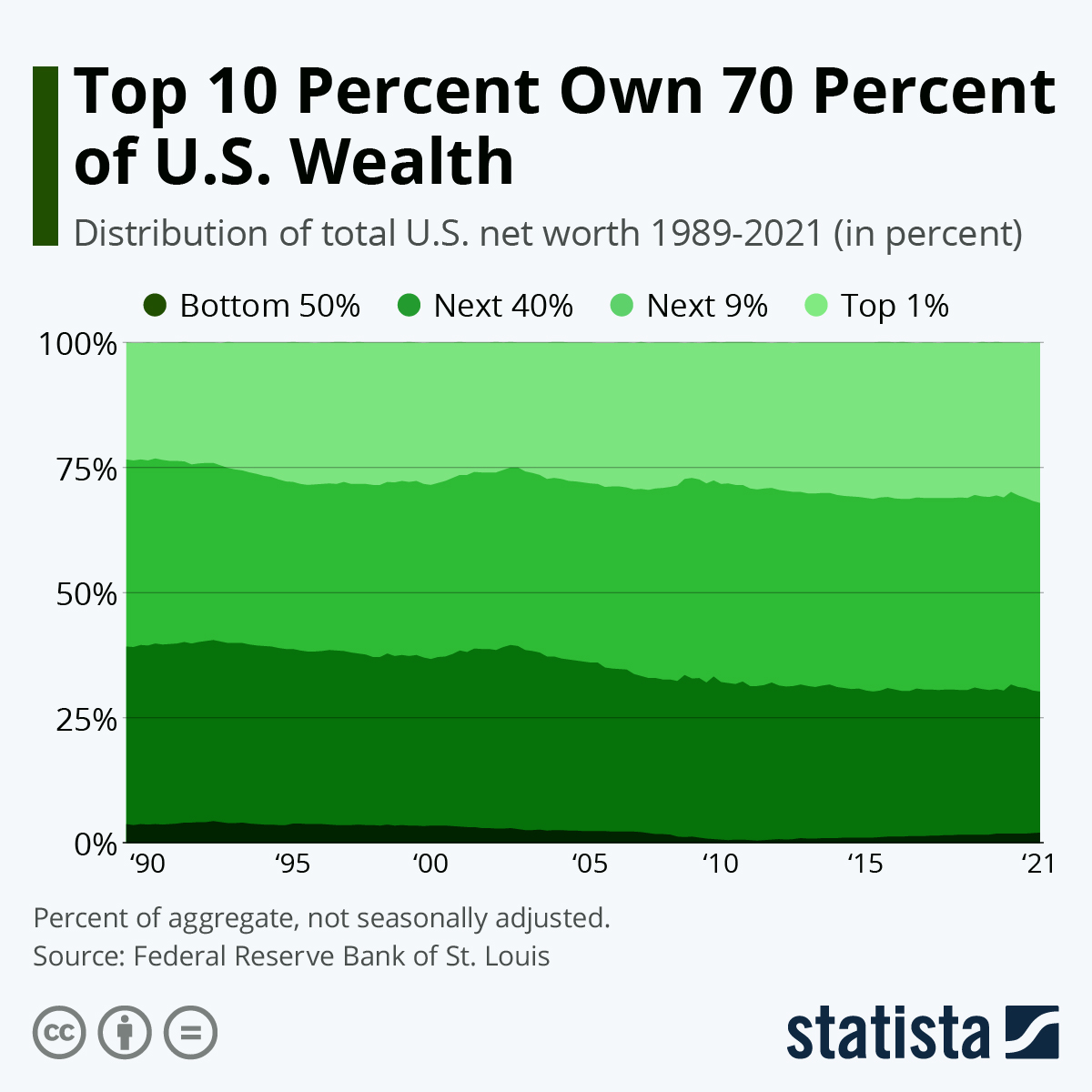

"The richest 10% own 70% of the wealth" citation please.

Infographic: The Top 10 Percent Own 70 Percent of U.S. Wealth

This chart shows the distribution of U.S. net worth among population percentiles.

Honestly, I am surprised that it is not much higher, but there it is.

Yakuda

Verified User

Thanks I'll look it over. In the future save us from having to ask for it

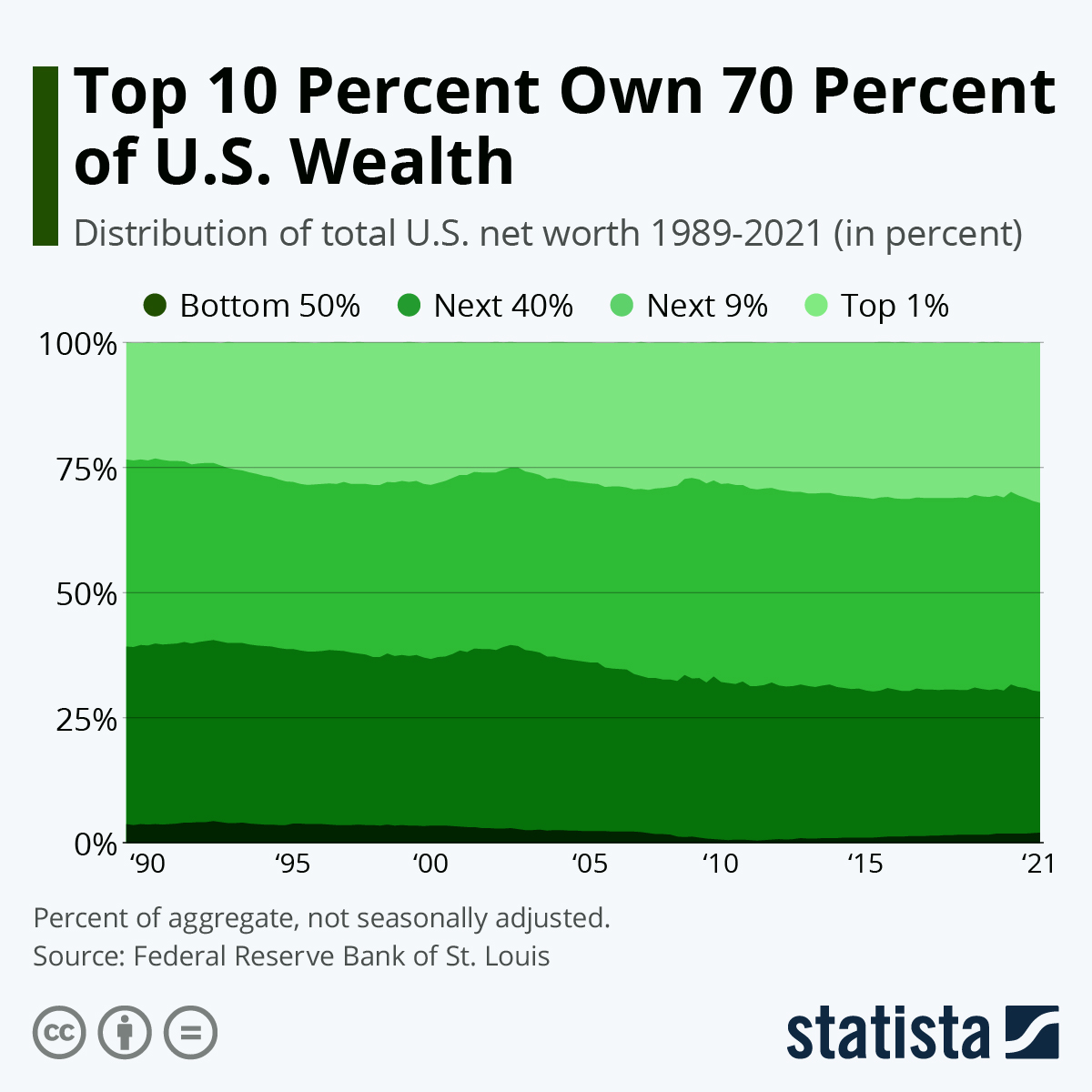

Infographic: The Top 10 Percent Own 70 Percent of U.S. Wealth

This chart shows the distribution of U.S. net worth among population percentiles.www.statista.com

Honestly, I am surprised that it is not much higher, but there it is.

Yakuda

Verified User

So it's based on households with only $1 million is total assets. They number of people in that category has risen steadily and dramatically.

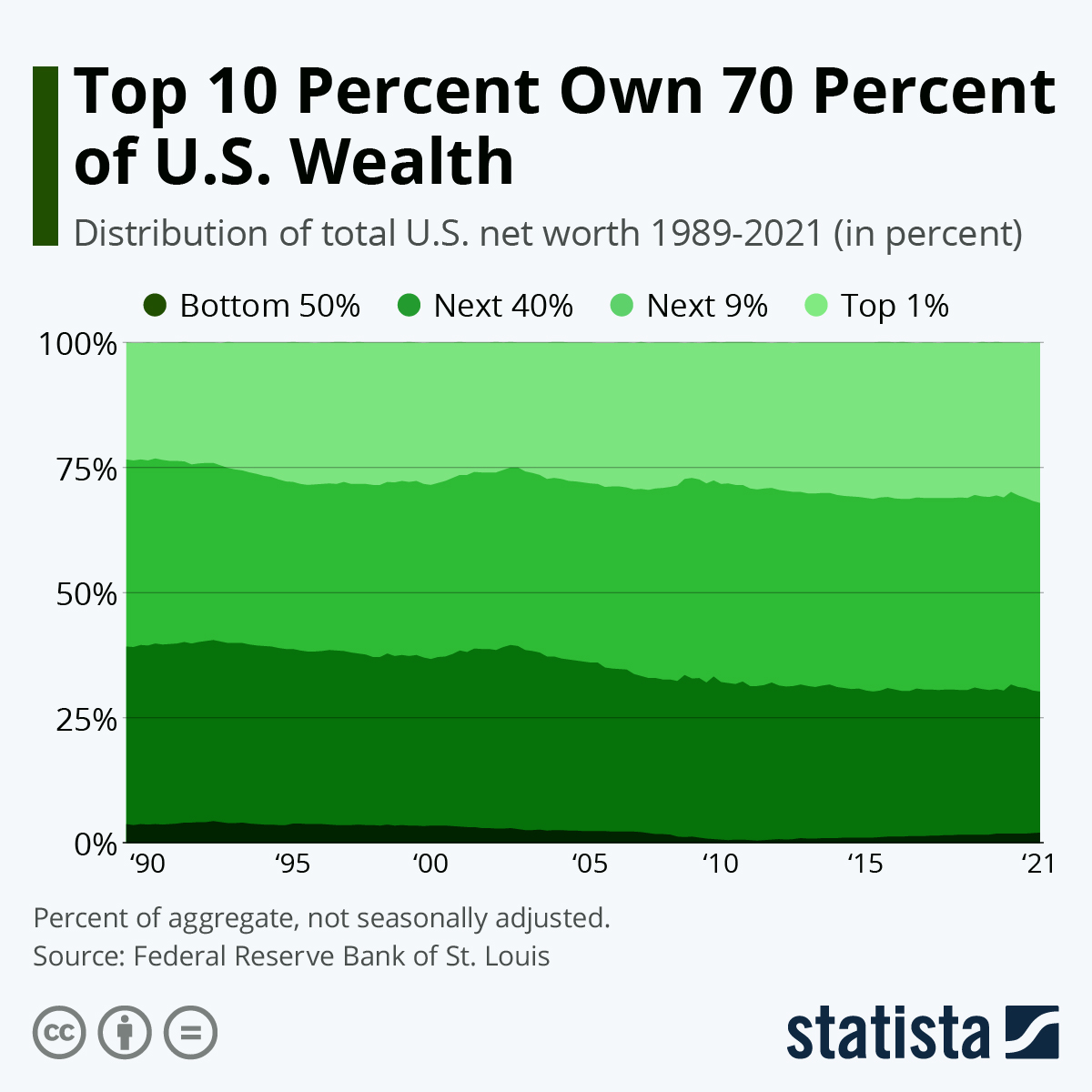

Infographic: The Top 10 Percent Own 70 Percent of U.S. Wealth

This chart shows the distribution of U.S. net worth among population percentiles.www.statista.com

Honestly, I am surprised that it is not much higher, but there it is.

Teflon Don

I'm back baby

Good. Time for these places to get off the gubmint teatPublic universities in the Midwest are raising prices for out-of-state students, as Florida schools consider making the same move for the first time since 2012.

Cornell and Duke are among the colleges weighing layoffs. The University of Minnesota is cutting hundreds of jobs, even as undergraduate tuition soars as much as 7.5 percent.

Just as America’s colleges are preparing to welcome what could be the largest freshman class in the nation’s history, political and economic forces are unleashing havoc on higher education budgets. Schools are grappling with meager upticks in state support and topsy-turvy economic forecasts, and Republicans in Washington are pursuing federal budget cuts and threatening tax hikes.

Trump: Make America Dumb

It is based on who is in the top 10%.So it's based on households with only $1 million is total assets. They number of people in that category has risen steadily and dramatically.

T. A. Gardner

Serial Thread Killer

And, they pay about 70% of the taxes too. Why is that a problem?

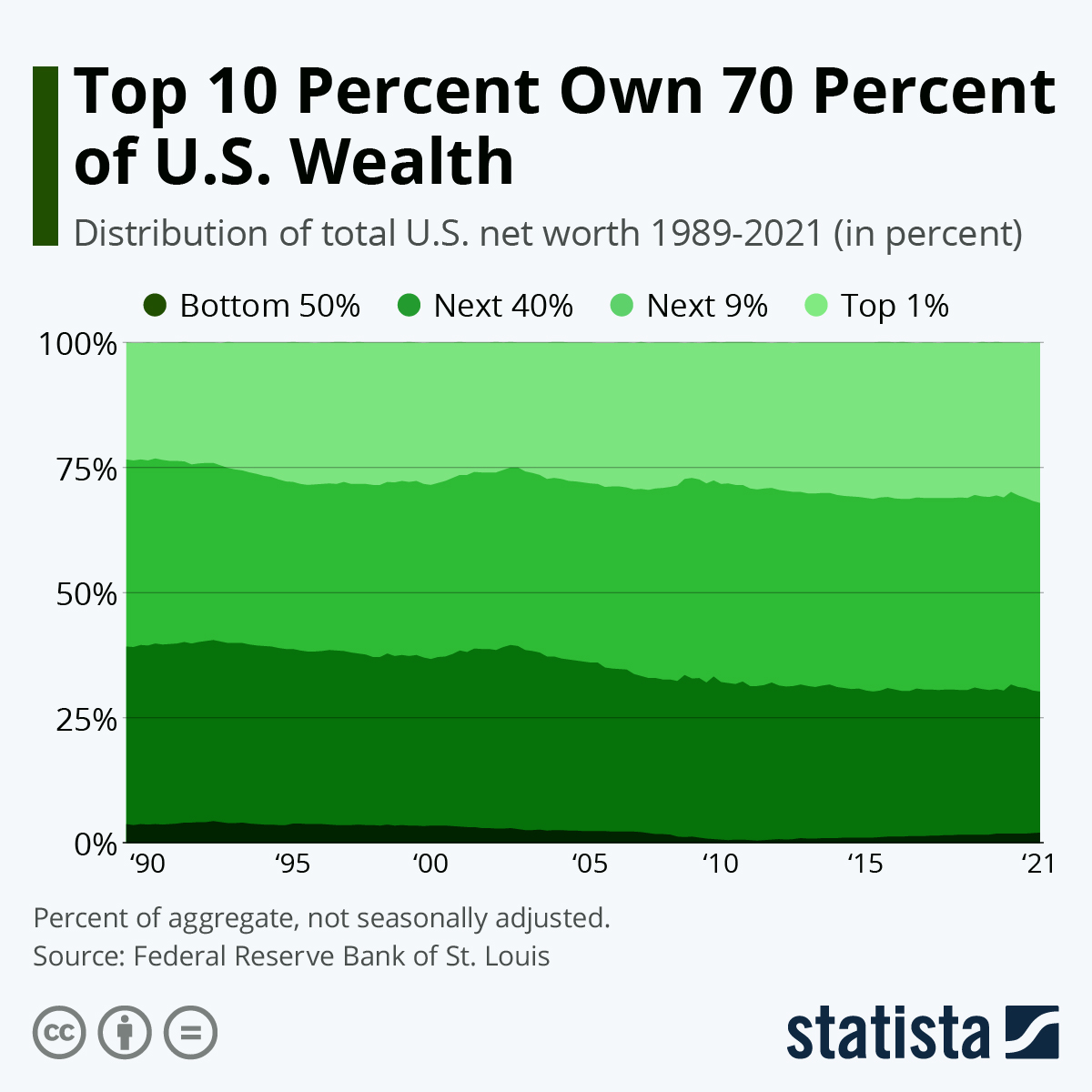

Infographic: The Top 10 Percent Own 70 Percent of U.S. Wealth

This chart shows the distribution of U.S. net worth among population percentiles.www.statista.com

Honestly, I am surprised that it is not much higher, but there it is.

Who pays the most income tax? | USAFacts

In 2022, the top 5% of earners collectively paid over $1.3 trillion in income taxes, or about 61% of the national total.

T. A. Gardner

Serial Thread Killer

Who cares? What difference does it make?It is based on who is in the top 10%.

Yakuda

Verified User

Right people with asset totally only $1 million. That's hardly "rich".It is based on who is in the top 10%.

Yakuda

Verified User

First of all piss face, keeping a military is explicitly stated in the Constitution as a job for the federal govt. Education is not. Health care is not. R&d is not. Childcare sure as shit is not. Second every Dept in the federal govt needs to be gutted. Id ask you to justify your claims but youre just a loud mouth "tuff" guy with lady parts thats scaredYes, we definitely need massive cuts to the defense budget, as much as RWers really, really love bombs and missiles and jets and wars. Think of all the nice things we could afford: cheaper or free higher education. National health care plan for all. Better infrastructure. Plenty for scientific and medical R&D. Help with daycare costs. We could join the rest of the civilized world by using our citizens' taxes to benefit them rather than benefit the military-industrial complex.

Do they?And, they pay about 70% of the taxes too. Why is that a problem?

First off, there is almost no wealth taxes in America, so no link between wealth and taxes. As long as you realize no taxable gains, you can be a billionaire and still owe no taxes. That is amazingly easy to do.

Then there is the issue of state and payroll taxes. Those both lean more heavily on people in the bottom 90%.

It really does not matter, but your claim seems a little weird.

T. A. Gardner

Serial Thread Killer

Do they?

First off, there is almost no wealth taxes in America, so no link between wealth and taxes. As long as you realize no taxable gains, you can be a billionaire and still owe no taxes. That is amazingly easy to do.

Wealth taxes are an obscene robbery. They confiscate accumulated wealth, often by careful management of one's money and sometimes over generations. Paying taxes on money earned and realized is one thing. Taking someone's wealth when it is unearned, like say on real estate that is sitting using some artificial estimate of its value is just robbing someone of their future earnings twice since, no doubt, any gains made when sold would be taxed also. It would also argue that the wealthy would not invest in anything that could be 'wealth taxed' away.

For example, if a wealth tax was placed on the estimated value of a home and its increase in value each year, it would incentivize renting over owning and not doing anything to improve the property. To the contrary, it would be wiser to let it go to seed, take a deduction for loss of value and then eventually abandon the property once it fell into ruin.

You then start over somewhere new with a huge mortgage to pay off to avoid having your wealth taxed away.

Then there is the issue of state and payroll taxes. Those both lean more heavily on people in the bottom 90%.

I have no issue with FICA being taken from all wages earned not just to some maximum. Of course, I'd rather see it individually invested than in a government pot that Congress has access to.

My claim is accurate, and clearly you don't grasp the realities of wealth and money.It really does not matter, but your claim seems a little weird.

Property taxes are a wealth tax.Wealth taxes are an obscene robbery.

A small wealth tax does keep wealth being used well. For instance, without a wealth tax, I can just buy a bunch of land and sit on it forever. It holds back economic growth.

But in general, I am against a wealth tax, as I am also against paying off all the national debt. But like with paying off a mortgage, the normal way to payoff an entire debt at once is not with income, but by selling off wealth. In the case of a mortgage, usually the mortgage is paid off entire at once by selling the house it is connected to.

In theory, the wealth tax on homes are passed through to renters. There is no incentive to rent. We know that because there is a wealth tax on homes (and other forms of property), and yet Americans still buy houses.For example, if a wealth tax was placed on the estimated value of a home and its increase in value each year, it would incentivize renting over owning and not doing anything to improve the property.

How about on unearned income, just like earned income? If we charged FICA on all income, we would have a budget surplus.I have no issue with FICA being taken from all wages earned not just to some maximum.

T. A. Gardner

Serial Thread Killer

Property taxes are a wealth tax.

And, I'm opposed to them on a primary private residence. Taxing commercial properties and the like is fine, but your personal home? No.

A small wealth tax does keep wealth being used well. For instance, without a wealth tax, I can just buy a bunch of land and sit on it forever. It holds back economic growth.

What's wrong with that? The government sits on a bunch of land forever and holds back economic growth because of it. Is that okay?

In theory, the wealth tax on homes are passed through to renters. There is no incentive to rent. We know that because there is a wealth tax on homes (and other forms of property), and yet Americans still buy houses.

There is every incentive to rent. You don't gain any advantage from owning unless you are a business that can write the tax off.

Because unearned income isn't real, it's imagined. That is, it is income not realized and not usable or tangible.How about on unearned income, just like earned income? If we charged FICA on all income, we would have a budget surplus.

So a community of owner occupied houses would have no money for schools? The suburbs would be destroyed by that.And, I'm opposed to them on a primary private residence.

By definition, unearned income is realized, so even by your definition it is not imaginary. I can understand you saying unrealized capital gains should not be taxed, but once you realize it, it is real.Because unearned income isn't real, it's imagined. That is, it is income not realized and not usable or tangible.

Indeed.And, they pay about 70% of the taxes too. Why is that a problem?

Who pays the most income tax? | USAFacts

In 2022, the top 5% of earners collectively paid over $1.3 trillion in income taxes, or about 61% of the national total.usafacts.org

We can be sure of one thing, Never Right Walter is not in the top half of taxpayers.

Matt Dillon

Retardium User

What part of "If you want more education, you should pay for it". Did you not get?Can we put you down for not supporting research and higher education? Are you from the school of “only the wealthy should be educated”?

Uncle Sugar paid for most of my education. Covered most things, but I had had a part-time job for gas, food, and incidentals.

There were requirements for that, though.

GPA requirements.

Based on the latest IRS data available for 2022, the top 1% of taxpayers:

The left would tax the top 1% at 100% if they could.

The right prevents this.

- Pay the highest average income tax rate: Their average income tax rate was 26.1% in 2022, which is significantly higher than the average rate of 3.7% paid by the bottom half of taxpayers. This demonstrates the progressive nature of the U.S. federal income tax system.

The left would tax the top 1% at 100% if they could.

The right prevents this.

T. A. Gardner

Serial Thread Killer

I buy some land for say, $10,000. I hold onto it for 10 years. What's its worth? How are you going to determine that accurately?So a community of owner occupied houses would have no money for schools? The suburbs would be destroyed by that.

By definition, unearned income is realized, so even by your definition it is not imaginary. I can understand you saying unrealized capital gains should not be taxed, but once you realize it, it is real.