DamnYankee

Loyal to the end

Hey pea brain...you can't invent a cliff, say we're on the edge of it and expect everyone to jump.

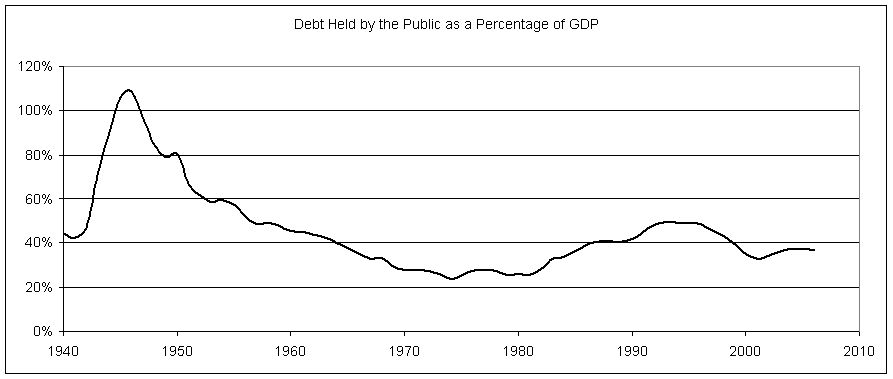

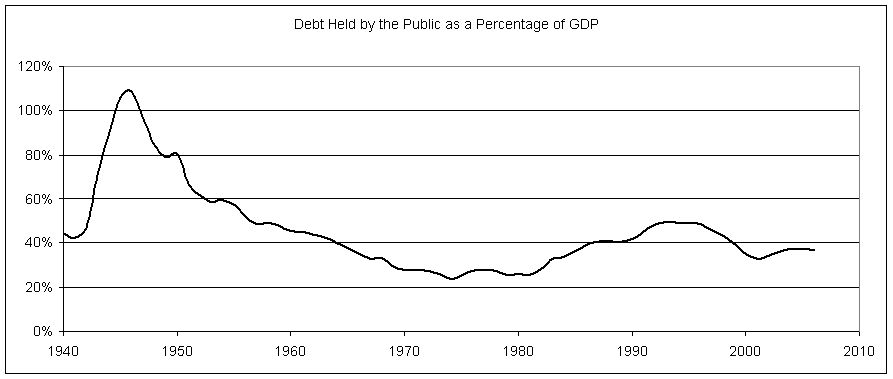

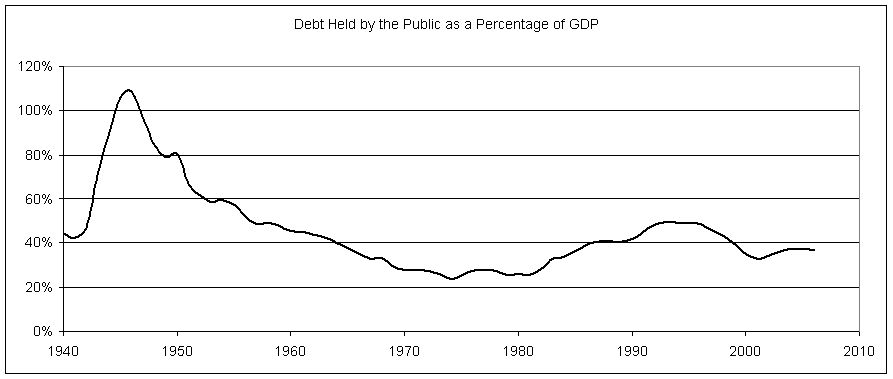

Here is the precipice we are NOT on...

Your chart is wrong:

Hey pea brain...you can't invent a cliff, say we're on the edge of it and expect everyone to jump.

Here is the precipice we are NOT on...

Hey pea brain...you can't invent a cliff, say we're on the edge of it and expect everyone to jump.

Here is the precipice we are NOT on...

If you remove the government spending portion of GDP, I imagine the numbers would look more disastrous.Current Debt is about 14.4 Trillion. 2010 GDP was about 14.5 Trillion. Can you do the math from there or do you want me to show you how close that is to 100%?

Your chart is wrong:

NO, my chart shows the debt held by the public as a percentage of GDP, going back to 1940. Your chart show gross debt. Debt held by the public as a percentage of GDP is the proper construct. Gross debt is not.

But even gross debt is not what is was in 1946.

MYTH: The federal debt ratio is at record levels.

Fact: Economic growth has reduced the debt ratio below the historical average.

In 2008, America’s $5.4 trillion public debt represents 38 percent of its $14.3 trillion GDP. Despite all the hand-wringing over increased budget deficits, the 38 percent debt ratio is below the post-World War II average of 43 percent. Consequently, America’s debt burden is, in fact, low by historical standards. In fact, the current 38 percent debt ratio is below the ratio at any point during the 1990s. There is no mystery to why the debt ratio has dropped so much since World War II: Economic growth has dwarfed the rate of new debt issuance. Since 1946, inflation-adjusted debt has grown by 114 percent, but the economy has grown by 532 percent—nearly five times as rapidly.

this has to be the dumbest fucking excuse I have heard to date.

Tell us moron.... what happens when the debt COMES DUE and the country can't afford to pay the principle and decides to roll it over. Do you believe interest rates are going to be low forever?

Fucking idiots on the left will continue doing anything and everything to spend spend spend. The justifications blew past full retard and are all out insane now.

IF interest rates are your concern, then you should be SCREAMING to raise the debt ceiling and calling the teabaggers holding it hostage terrorists.

You really are a pea brain aren't you? Hey pea brain, try THIS...default on credit card payments and SEE what happens to interest rates.

Is there room in your little pea to fit the FACT raising the debt ceiling ONLY effects payment on what we ALREADY SPENT???

IF interest rates are your concern, then you should be SCREAMING to raise the debt ceiling and calling the teabaggers holding it hostage terrorists.

You really are a pea brain aren't you? Hey pea brain, try THIS...default on credit card payments and SEE what happens to interest rates.

Is there room in your little pea to fit the FACT raising the debt ceiling ONLY effects payment on what we ALREADY SPENT???

you really are the pea brain. government doesn't control itself, WE THE PEOPLE must do that. So how does one get a petulant little child that doesn't listen to you, to stop spending?

answer: you take away the credit card.

OK PEA brain...the CBO lays it out perfectly clear...CRYSTAL.

BTW, the CBO ALSO uses Federal Debt Held by the Public (Percentage of GDP) which is the correct construct, unless you view America as another Zimbabwe.

The chart show 2 scenarios. For all practical purposes, you can call the Extended-Baseline Scenario is the Democrat scenario and the Alternative Fiscal Scenario the Teapublican PEA BRAIN scenario.

The Extended-Baseline Scenario adheres closely to current law. Under this scenario, the expiration of the tax cuts enacted since 2001 and most recently extended in 2010, the growing reach of the alternative minimum tax, the tax provisions of the recent health care legislation, and the way in which the tax system interacts with economic growth would result in steadily higher revenues relative to GDP.

The Alternative Fiscal Scenario

The budget outlook is much bleaker under the alternative fiscal scenario, which incorporates several changes to current law that are widely expected to occur or that would modify some provisions of law that might be difficult to sustain for a long period. Most important are the assumptions about revenues: that the tax cuts enacted since 2001 and extended most recently in 2010 will be extended; that the reach of the alternative minimum tax will be restrained to stay close to its historical extent; and that over the longer run, tax law will evolve further so that revenues remain near their historical average of 18 percent of GDP. This scenario also incorporates assumptions that Medicare’s payment rates for physicians will remain at current levels (rather than declining by about a third, as under current law) and that some policies enacted in the March 2010 health care legislation to restrain growth in federal health care spending will not continue in effect after 2021.

IRONY...The Republicans want the budget to be balanced by keeping spending down rather than by raising tax revenues. They thus propose limiting spending to no more than 18% of gross domestic product (GDP).

The Teabagger party of PEA brains...