FUCK THE POLICE

911 EVERY DAY

More from the second greatest economist of all time (after Keynes).

http://krugman.blogs.nytimes.com/2009/10/30/stimulating-thoughts-3rd-quarter-edition/

Stimulating thoughts, 3rd quarter edition

The good news from the new GDP report is that the fiscal stimulus seems to be working just about the way a sensible Keynesian approach says it should. The bad news from the new GDP report is that the fiscal stimulus seems to be working just about the way a sensible Keynesian approach says it should.

Josh Bivens at EPI has a good overview of the evidence that the stimulus is working. As he says,

OK, now for the bad news. What we’d really like to see isn’t just successful job creation; we’d like to see “pump-priming” or “jump-starting” — that is, we’d like to see stimulus jolting the economy into self-sustaining growth. It’s important to understand that this isn’t required to make stimulus worthwhile — it’s neither a prediction of the standard models nor a part of the basic welfare argument for stimulus. But it would be nice if it happened.

And more to the point, if there isn’t a whole lotta jump-starting going on, the original judgment I and others reached — that the stimulus is way too small — stands.

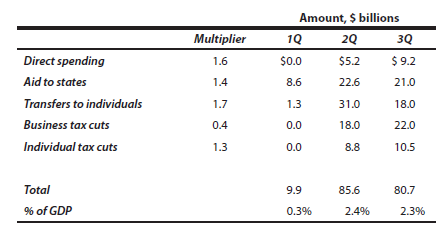

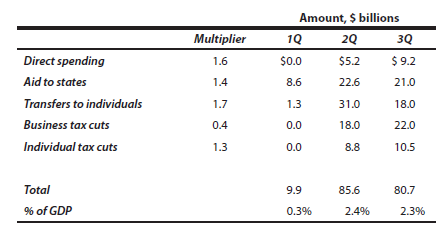

The basic economic logic says that the stimulus should aim to close the output gap. And it’s obviously not remotely large enough to be doing that right now. Nor will it come close in the future. Here’s a useful table from EPI on the stimulus so far:

Economic Policy Institute

Economic Policy Institute

The key point from this table is that while most of the stimulus has yet to be spent, the rate of spending as a percentage of GDP is already fairly high (take that, Richard Posner), close to the maximum it will reach over the whole course of the plan. That means that we’ve already seen much if not most of the impact of the stimulus on growth.

A few caveats apply — mainly, some of the indirect effects will still mount over time. For example, the ARRA has probably saved as many schoolteachers’ jobs as it’s going to — but the indirect effect of those jobs saved on, say, employment at the stores where the teachers buy their groceries hasn’t been fully felt yet. That’s why Christy Romer says that the ARRA’s effect won’t peak until the middle of next year.

Still, we’ve gotten the big boost, and it’s clearly far short of what we really need.

And yes, we can afford more.

http://krugman.blogs.nytimes.com/2009/10/30/stimulating-thoughts-3rd-quarter-edition/

Stimulating thoughts, 3rd quarter edition

The good news from the new GDP report is that the fiscal stimulus seems to be working just about the way a sensible Keynesian approach says it should. The bad news from the new GDP report is that the fiscal stimulus seems to be working just about the way a sensible Keynesian approach says it should.

Josh Bivens at EPI has a good overview of the evidence that the stimulus is working. As he says,

A serious look at the evidence argues that this debate should be closed: ARRA has played a starring role in pushing the economy into positive growth.

In another piece, Bivens notes that the usual suspects are now moving the goalposts, conceding that the stimulus is producing growth but saying that it’s not “genuine” growth because … it was caused by the stimulus. Ahem. Actually, the whole rationale for fiscal stimulus — a rationale you can derive from models with all the intertemporal maximizing stuff, if you like — is that it puts resources that would otherwise be unemployed to work. If you do that, you’ve helped the economy; there’s no distinction between genuine and artificial employment.

OK, now for the bad news. What we’d really like to see isn’t just successful job creation; we’d like to see “pump-priming” or “jump-starting” — that is, we’d like to see stimulus jolting the economy into self-sustaining growth. It’s important to understand that this isn’t required to make stimulus worthwhile — it’s neither a prediction of the standard models nor a part of the basic welfare argument for stimulus. But it would be nice if it happened.

And more to the point, if there isn’t a whole lotta jump-starting going on, the original judgment I and others reached — that the stimulus is way too small — stands.

The basic economic logic says that the stimulus should aim to close the output gap. And it’s obviously not remotely large enough to be doing that right now. Nor will it come close in the future. Here’s a useful table from EPI on the stimulus so far:

The key point from this table is that while most of the stimulus has yet to be spent, the rate of spending as a percentage of GDP is already fairly high (take that, Richard Posner), close to the maximum it will reach over the whole course of the plan. That means that we’ve already seen much if not most of the impact of the stimulus on growth.

A few caveats apply — mainly, some of the indirect effects will still mount over time. For example, the ARRA has probably saved as many schoolteachers’ jobs as it’s going to — but the indirect effect of those jobs saved on, say, employment at the stores where the teachers buy their groceries hasn’t been fully felt yet. That’s why Christy Romer says that the ARRA’s effect won’t peak until the middle of next year.

Still, we’ve gotten the big boost, and it’s clearly far short of what we really need.

And yes, we can afford more.