Cancel 2016.11

Darla

Biden said it. Obama didn't. That is at least my memory.

It's crap.

Oh yeah you are right.

Biden said it. Obama didn't. That is at least my memory.

It's crap.

Oh yeah you are right.

Dude.....they have to let the payroll tax expire. It's what pays for social security."Obama won't touch Social Security"

Obama Hits Social Security In Fiscal Cliff Offer Friendlier To The Wealthy

WASHINGTON -- President Barack Obama, with his latest fiscal cliff offer, proposes extending the Bush tax cuts for everyone earning less than $400,000 a year, and paying for it by increasing taxes on the middle class and cutting Social Security and Medicare.

Obama's offer would allow the payroll tax holiday to expire, meaning middle class workers will see smaller paychecks in 2013. Economists have warned that the recovery is too fragile to risk a broad tax hike on workers. It would also gradually reduce Social Security, pension and Medicare benefits seniors are due to receive, taking a small bite up front, but building up to much larger cuts over time.

Obama's concession to Republicans is opposed by a majority of Americans, according to a HuffPost/YouGov poll. Fifty-two percent of survey respondents said the payroll tax cut should be extended to avoid raising taxes on the middle class, while 22 percent said that it should be allowed to expire to help pay down the debt. Extending the payroll tax cut received bipartisan support: 64 percent of Democrats and 57 percent of Republicans in the survey said they supported the extension.

MoveOn.org, the largest online progressive organization in Washington, reacted angrily Monday night to reports that Obama was softening. The group's quick reaction to a possible deal that has yet to be announced publicly shows there will be fierce opposition to cuts that hit Social Security, Medicare or Medicaid beneficiaries.

more

http://www.huffingtonpost.com/2012/12/18/obama-social-security-fiscal-cliff_n_2319850.html

ONLY the braindead didn't know this was going to happen.

The payroll tax cut doesn't take any money away from SS. It was a smart tax cut intended to stimulate consumer spending in a soft economy and which benefited lots of people that don't earn a whole lot of money. Ending it is stupid in this economy, particularly where you agree to enact tax cuts for people earning between $200,000 and $400,000. Those people don't need any tax cuts.

The idea that SS doesn't help drive the deficit is crazy.

As long as neither side is willing to touch its own sacred cows - for Dems, SS & Medicare, and for the GOP, defense and taxes - the idea of compromise on this issue is fantasy.

Which is a shame, because without compromise, nothing will really get done. And if nothing really gets done, SS, Medicare, defense & taxes will be the least of our problems.

OK where am I missing something? So for I've seen a tentative offer from the Obama administration in which they will use the chained CPI for adjusting cost of living increases for higher income Americans only.....no details specified.......and not across the board but that is just an offer and not the legislation.The only good thing about Obama's offer is that it will not be accepted. Even people that advocate cutting benefits as a means of "fixing" Social Security generally don't advocate cutting benefits as the only method of doing so. Offering to do so without proposing to increase the cap on income subject to the tax is asininity of the highest order.

Call you Senators and Reps.

Cuts to SS are inevitable, and will only get worse. Even the most ardent supporters of SS anticipate a 25% cut in payouts by 2037.

It's time to address SS in a meaningful way, that ensures security for seniors - and by that, I mean privatization.

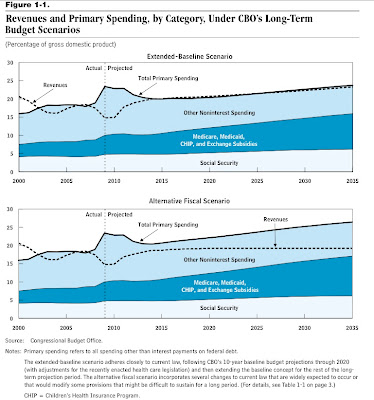

This is just plain not true. Here are charts of projected long-term spending. Social Security isn't unsustainable at all (it's the part on the bottom that barely rises):

Personally, I don't care. My SS has already been fought for and secured. Whatever happens to the next generation is whatever happens.

If it ends for them, they didn't deserve it anyway.

Anyone who thinks Obama is not going to cut SS and Medicare don't deserve either.

SEE: Catfood Commission.

Do the math dude. SS is not a driver of our national debt. That's just a fact.The idea that SS doesn't help drive the deficit is crazy.

As long as neither side is willing to touch its own sacred cows - for Dems, SS & Medicare, and for the GOP, defense and taxes - the idea of compromise on this issue is fantasy.

Which is a shame, because without compromise, nothing will really get done. And if nothing really gets done, SS, Medicare, defense & taxes will be the least of our problems.

So fucking what? It's an easy fix. This has happened before. Just raise the cap to account for inflation since the last time the payroll tax cap was adjusted. Problem solved!This is more or less a cherrypick. The CBO has SS going up as a % of our GDP by almost 3% in the next 30 years. They also write the following:

"Another commonly used measure of the program’s sustainability

is the trust funds’ exhaustion date, which CBO

projects will be 2039 under the extended-baseline scenario

and 2037 under the alternative fiscal scenario.8

Once the trust funds are depleted, the Social Security

Administration would no longer have legal authority to

pay benefits. In the years following the exhaustion of the

trust funds, annual outlays would therefore be limited to

annual revenues. As a result, the benefits that can be paid

under current law are substantially lower than the benefits

that are scheduled to be paid"

Do the math dude. SS is not a driver of our national debt. That's just a fact.

Bernie Sanders Applauds Obama for Taking Social Security Off the Fiscal Cliff Table

NOVEMBER 27. 2012

After the White House took Social Security off the fiscal cliff negotiating table, Sen. Bernie Sanders applauded the move and called it a step in the right direction.

Yesterday, White House Press Secretary Jay Carney said Social Security was not on the fiscal cliff negotiating table, “We should address the drivers of the deficit and Social Security currently is not a driver of the deficit.”

more

http://www.politicususa.com/bernie-sanders-applauds-obama-social-security-fiscal-cliff-table.html

This was just three weeks ago.

Who do you believe .. what is Obama's negotiating history?

This is more or less a cherrypick. The CBO has SS going up as a % of our GDP by almost 3% in the next 30 years. They also write the following:

"Another commonly used measure of the program’s sustainability

is the trust funds’ exhaustion date, which CBO

projects will be 2039 under the extended-baseline scenario

and 2037 under the alternative fiscal scenario.8

Once the trust funds are depleted, the Social Security

Administration would no longer have legal authority to

pay benefits. In the years following the exhaustion of the

trust funds, annual outlays would therefore be limited to

annual revenues. As a result, the benefits that can be paid

under current law are substantially lower than the benefits

that are scheduled to be paid"

I've done the math, and so has the CBO. It isn't pretty. People are in denial about SS.

Some sort of cut is inevitable. Lifespans in the next 50 years will expand beyond what we now consider "normal", in a big way. Combined with exponential population increase, as well as cost of living increases, and SS is a wholly unsustainable program.

Bernie Sanders Applauds Obama for Taking Social Security Off the Fiscal Cliff Table

NOVEMBER 27. 2012

After the White House took Social Security off the fiscal cliff negotiating table, Sen. Bernie Sanders applauded the move and called it a step in the right direction.

Yesterday, White House Press Secretary Jay Carney said Social Security was not on the fiscal cliff negotiating table, “We should address the drivers of the deficit and Social Security currently is not a driver of the deficit.”

more

http://www.politicususa.com/bernie-sanders-applauds-obama-social-security-fiscal-cliff-table.html

This was just three weeks ago.

Who do you believe .. what is Obama's negotiating history?

So good to see you back!

What exponential population increase? Birth rates have been on the decline and the average children per woman is now about 1.9, which is below the level needed to simply maintain the population.

A cut is not inevitable. As the fiscal status can be addressed in multiple ways other than cuts. Unless you are counting raising the age requirement for FRA a cut. That should be adjusted based on average life expectancy. That said, even that doesn't have to happen.

The payroll tax cut doesn't take any money away from SS.?

Thats about as stupid a statement as I've seen in awhile....How tf do you think SS is funded ?....fuckin' magic ?

Payroll taxes fund bot SS and Medicare....so don't talk so stupid....

SS and Medicare are funded and fully paid for and solvent.....and its as simple as raising the high end cutoff limit to fund it further into the futrure

for seniors and the poor.....