signalmankenneth

Verified User

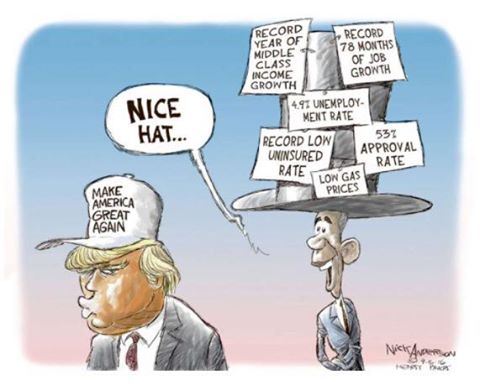

How about these things?

Hmmmmm.....let me think..............nope, can't come up with anything other than make things worse for young blacks economically, make things worse for middle class Americans as a whole, double down on US debt and deficit spending and massively divide the country.

Are you pretending to care about the economic status of black Americans?

Are you pretending to care about the economic status of black Americans?

Actually, it's nothing like Dodd Frank. G/S would have done nothing to prevent the housing crash.Glass - Steagall should have never been repealed in the 90's, and needs to be put back in its full text repealing Dodd - Frank. Dodd - Frank is a watered down version of Glass - Steagall.

You can either remain ignorant of the facts, and continue to stretch this thread with inane posts, or you can take the 5 minutes necessary to bring yourself up to speed.The board notes you did NOT produce the requested evidence for your statement. Only an idiot like you would accept obama's word that the companies he bailed out paid back the money.

You still have no idea what the Fed does? What were interest rates when Bush left office....and who sets the rates?Another monster obozo screw up is the 8 years of super-low interest rates. Pensions had always been able to invest in 30 year govt bonds that paid 6-8%. Under O it's been 2-4%. Pensions have had 8 years of lagging income while their payouts have not dropped. They are doomed.

Both Reagan and Bush increased public sector hiring in order to stave off unemployment. Would you suggest Obama do the same? What else do you do for the millions who lost jobs after the Bush era housing bubble burst....let them starve?At the same time adding 15+ million more to the food stamp roles.

Correct. It seems many in this thread don't understand how the Treasury, or the Fed work. Another genius thing Obama negotiated with GM was to make the union take stock shares in lieu of other compensation. In essence, they would bargain against themselves in contract negotiations.Some one Tutor this kid with this story, and explain to him the unpaid balance is held by the Treasury dept in the form of stock, and the Treasury Dept,has not sold their holdings. This story is very easy to understand, the Treasury dept. has been paid back with interest by the auto manufactures. Because I am done with this guy, all he has is a nunt'ah argument. No reason, no logic, just don't want to get along.

Actually, it's nothing like Dodd Frank. G/S would have done nothing to prevent the housing crash.

Correct. It seems many in this thread don't understand how the Treasury, or the Fed work. Another genius thing Obama negotiated with GM was to make the union take stock shares in lieu of other compensation. In essence, they would bargain against themselves in contract negotiations.

You are obviously are not reading the whole story, and you leave out the fact, the story was a reply to the poster claiming the bailout money was a gift. So how can any automaker owe anything on a gift?

Some one Tutor this kid with this story, and explain to him the unpaid balance is held by the Treasury dept in the form of stock, and the Treasury Dept,has not sold their holdings. This story is very easy to understand, the Treasury dept. has been paid back with interest by the auto manufactures. Because I am done with this guy, all he has is a nunt'ah argument. No reason, no logic, just don't want to get along.

http://www.forbes.com/sites/brianso...-taxpayers-with-10-million-loss/#66d16dc85449DEC 9, 2013 @ 05:35 PM 17,468 VIEWS

Treasury Sells Final GM Shares, Sticking Taxpayers With $10 Billion Loss

Are you pretending to have brain?

You don't have a shred of evidence for any of those numbers.

I understand that G/S was little more than a firewall. I thought you said that D/F was the same, albeit watered down?That is not true. Glass-Steagall was a firewall between two different markets, depository institutions (Banks) and financial intermediaries (Investment Banks, Brokerages, Hedge Funds, etc.). A key tenet of a depository institution is that savers trust that their deposits will be there when they need it.

Depository Banks kept a ratio of cash on hand to meet this need and they loaned out the rest. However, the underbelly of the capitalist system is that during the business cycle, there comes a time when business cycles downward. Less demand results in excess capacity which drives greater liabilities for firms, job losses and eventually panic. Animal spirits are freed up causing depositors to want more of their cash back from the depository institutions.

The removal of the firewall between depository institutions and speculating financial intermediaries worsened with bank write downs of bad bets and hence the financial crisis. The depository institutions made bets (or speculated) with customers’ deposits in complex securitization markets. They were precluded from this behavior under Glass-Steagall. Capital cushions which they normally kept under Glass-Steagall were no longer adequate to meet post Glass-Steagall losses.

Dodd-Frank, did just the opposite of the Glass-Steagall Act. It allowed the abusive Wall Street banks to hold even greater amounts of insured deposits and to become ever more creative in how they abused those deposits. Make no mistake it has the full suport of our next President Hillary Clinton.

Post 33 clarifies anything that you're struggling with. Banks paid back notes with interest. They couldn't wait to, as they didn't like the restrictions attached to the bailout.you claimed it was paid back and provided the story as proof, but the story stated that it was never paid back and we lost $20b.....as I said, you shouldn't link stories you haven't read......

I understand that G/S was little more than a firewall. I thought you said that D/F was the same, albeit watered down?

D/F has been tweaked, unfunded, and ultimately works nothing like what was originally intended. But...it did make sure that banks cannot invest more than they have on hand in cash.

The reason I say the G/S would have done little to avoid the crash, is because there were so many private investment firms playing in the MBD markets that were not subject to the protections under G/S. Everyone was writing bad paper, with Wall St. demanding even more every day.