You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

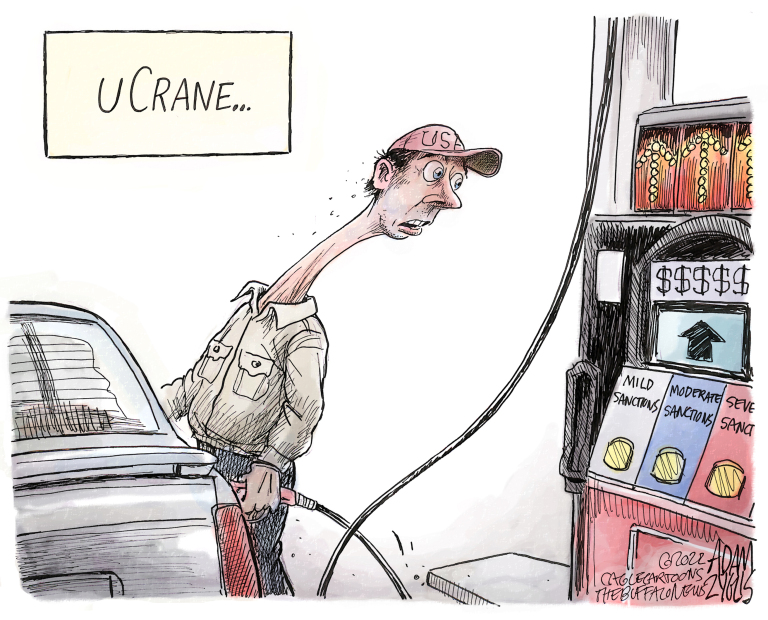

crude surges past $110 a barrel

- Thread starter anatta

- Start date

Well, for starters - conservatives wouldn't credit Biden for anything, regardless. That's the rule.

But can you be specific on the policies?

We credit him for the Afgan withdraw fiasco. We credit him for inflation and rising fuel prices. We credit him for being weak. There's three for starters.

gemini104104

Verified User

Crude surges past $110 a barrel and equities sink with investors growing increasingly fearful about the Ukraine war’s impact on global energy supplies and the economic recovery.

The measures have injected a huge amount of uncertainty into markets with supplies of crucial commodities including metals and grains soaring. The price of global staple wheat is sitting at a 14-year high — having risen 30 percent in the past month.

https://www.timesofisrael.com/liveblog-march-2-2022/

Considering trolls like you apparently are lacking in the intellectual competent area, considering some facts versus your trolling ignorance:

How Oil Could Hit $150. It’s Not Just About Russia.

RBC Capital Markets explained one scenario where oil prices could jump to record levels. It has more to do with demand than supply. For now, analyst Michael Tran sees very little pressure on the supply side to restrain prices. Oil supplies are growing at a relatively slow rate, in part because OPEC has been unwilling—and potentially unable—to boost production. Several OPEC members are not adding as much supply as they were expected to add under current limits.

If Russia invades Ukraine, supply could be reduced again, because countries might impose sanctions on Russian oil and reduce the amount of global supply available.

Demand is growing much faster and showing little sign of slowing down, even though oil prices are rising. A “release valve” for prices will have to come on the demand side, Tran predicts. At a certain point, people or companies will change their behavior based on prices, perhaps deciding not to travel or reducing car trips.

“We could be early, but the major cornerstone of our thesis over the next year, or longer, assuming the macro economy holds, is that the oil cycle will price higher until it finds demand destruction,” Tran wrote.

MORE ON OIL

Ukraine Tensions Push Oil and Gas Prices Higher

He doesn’t think that will happen for a while. History offers some guidance on when people could start to pull back on consumption. In 2008, U.S.-based oil prices hit their highest-ever level of $147 a barrel. Gasoline rose as high as $4.09 a gallon. In inflation-adjusted terms that would equate to $5.21 today. For gasoline to get to $5 a gallon, oil prices would have to rise to $150 per barrel.

https://www.barrons.com/articles/how-oil-could-hit-150-its-not-just-about-russia-51644856987

Matt Dillon

Retardium User

We credit him for the Afgan withdraw fiasco. We credit him for inflation and rising fuel prices. We credit him for being weak. There's three for starters.

The Anonymous

Bag On My Head

Mad Skillz Brandon

GREAT TIME TO BE ENERGY INDEPENDENT, INSTEAD OF FORCED TO BUY FROM OUR ENEMIES.

LET'S GO BRANDON!!

LET'S GO BRANDON!!

Airstrip One

Completely Effed

For fucks sake. I just gassed-up at Costco, and it was up to $4.20. My friend informed me, when he planned out his road trip out here from Denver this past Christmas, that my local Costco has the cheapest gas in the area. He was keen to stop by there a couple of times, and when he headed back home. So, that's a sobering thought...

For fucks sake. I just gassed-up at Costco, and it was up to $4.20. My friend informed me, when he planned out his road trip out here from Denver this past Christmas, that my local Costco has the cheapest gas in the area. He was keen to stop by there a couple of times, and when he headed back home. So, that's a sobering thought...

$4.49 here when I filled up 3 days ago. It's gone up since...

FJB