Good Luck

New member

Yea, you can read the press releases. I read the actual document, in its entirety, which downgrades the credit rating of the U.S. government, and the given reasons for doing so. Did you? Or did you limit yourself to the press release?If you actually read the press release and that's what you take away from it, you need your head examined. Or remedial reading comprehension. The S&P "upside" scenario assumes that the Bush tax cuts on high earned will lapse. It's clear that S&P thinks increased tax revenues must be part of the overall fiscal policy changes necessary to improve its outlook on US debt.

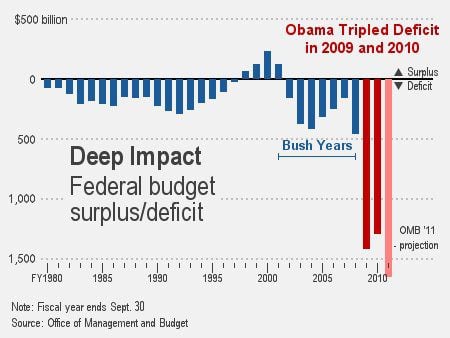

I already mentioned the "upside alternate scenario", which includes the assumption that tax rates will be increased on higher income brackets, back to 2000 levels, with an anticipated $940 Billion dollars in increased revenues. I also read that the ONLY result of such a move would be to classify the U.S. credit rating as "AA+ Stable", removing the threat of any immediate further downgrades. Did you read that part? Did you understand it? They are saying that even if congress were to pass the "tax the rich" plan Obama and his mindless cronies keep advocating, it would do very little for the ultimate outlook of the U.S. economy. They most assuredly did NOT say such a move would have prevented the downgrade, and indeed imply quite the opposite, that such a move still would have made no difference because of the minimal impact it would have on the deficit, let alone the debt. The only thing "clear" in the upside alternate scenario is S&P knows full well that increasing revenues won't do shit for the economic situation.

Meanwhile, because the S&P report was not intended to be a comprehensive analysis of potential economic policies, nothing was discussed about the impact raising taxes on millions of small business owners will have on an already flagging economy. But I can guarantee, if/when the feds are STUPID enough to pass Obama's tax increase proposal, the reaction of small business owners will NOT be to start hiring more employees. In fact, the continued threat of increasing tax rates to year-2000 levels is a large factor in the continued stagnation of the economy. Business owners are not going to hire more employees, increasing their business costs, when the federal government is holding increased business costs in the form of higher taxes over their heads. Obama's rhetoric in 2010 was all about taxing those damned rich people (of whom the lower brackets in Obama's "rich" list also happen to provide the vast majority of jobs in our economy) and small businesses put off hiring new employees in spite of the stimulus, because they knew they could not survive the double whammy of increased labor costs AND increased taxes. In a good economy, small businesses could reasonably anticipate increased revenues outpacing the increased labor costs. But that simply is not so in an unstable economy we are currently facing. Not with the additional threat of higher taxes looming. It's a risk they are simply not willing to take.

Putting off the expiration until 2012 instead of simply dealing with it one way or the other was as stupid a move for the health of the economy as has ever been made by any administration of either flavor. Your precious democrats had BOTH houses, a filibuster proof Senate, AND the White House, and were too fucking chicken shit to put their policies in motion (because they knew full well, for all their rhetoric, the PEOPLE hate their stupid assed policies, and with good reason). The result is small business owners sitting on pins and needles, waiting for the ax to fall in 2012, and STILL not hiring because they still cannot survive a double whammy of increased labor costs AND increased taxes in an unstable, unsure economy.

Should Obama actually manage to push his additional idiocy on the economy (as if his health care travesty isn't bad enough) you can anticipate increased unemployment (as if 9+% isn't high enough), decreased business, which in turn will decrease current revenues, offsetting partially, if not entirely, any gains made from the increased rates.

In short, your "gotta increase taxes to increase revenues" is just one more mindless democrat-led mantra of lies and idiocy.

Put people back to work. That will both increase revenues and decrease obligations. Advocate self-employment; get people making their own incomes and paying taxes on them. Encourage entrepreneurs. Get people working on the energy crisis problem via small, individually owned businesses. Small mom-n-pop businesses in new fields, which provide a person or couple with a reasonable, sustainable income, have a historical habit of growing to small, and even larger businesses which employ several, tens, even hundreds of additional employees. Add a few thousand such businesses in a new economic field (such as renewable energy) and you get a growing, thriving economy. THAT is how you increase revenues: with a thriving economy. NOT by further soaking those on whom the current slacking economy depends.