You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The U.S. Is Not Drowning In Debt

- Thread starter Bfgrn

- Start date

Cancel 2016.2

The Almighty

OK PEA brain...the CBO lays it out perfectly clear...CRYSTAL.

BTW, the CBO ALSO uses Federal Debt Held by the Public (Percentage of GDP) which is the correct construct, unless you view America as another Zimbabwe.

The chart show 2 scenarios. For all practical purposes, you can call the Extended-Baseline Scenario is the Democrat scenario and the Alternative Fiscal Scenario the Teapublican PEA BRAIN scenario.

The Extended-Baseline Scenario adheres closely to current law. Under this scenario, the expiration of the tax cuts enacted since 2001 and most recently extended in 2010, the growing reach of the alternative minimum tax, the tax provisions of the recent health care legislation, and the way in which the tax system interacts with economic growth would result in steadily higher revenues relative to GDP.

The Alternative Fiscal Scenario

The budget outlook is much bleaker under the alternative fiscal scenario, which incorporates several changes to current law that are widely expected to occur or that would modify some provisions of law that might be difficult to sustain for a long period. Most important are the assumptions about revenues: that the tax cuts enacted since 2001 and extended most recently in 2010 will be extended; that the reach of the alternative minimum tax will be restrained to stay close to its historical extent; and that over the longer run, tax law will evolve further so that revenues remain near their historical average of 18 percent of GDP. This scenario also incorporates assumptions that Medicare’s payment rates for physicians will remain at current levels (rather than declining by about a third, as under current law) and that some policies enacted in the March 2010 health care legislation to restrain growth in federal health care spending will not continue in effect after 2021.

IRONY...The Republicans want the budget to be balanced by keeping spending down rather than by raising tax revenues. They thus propose limiting spending to no more than 18% of gross domestic product (GDP).

The Teabagger party of PEA brains...

So what you are saying is that we don't REALLY need to pay social security/medicare/medicaid???? Those promises by the government to pay those bills don't count?

idiot

OK PEA brain...the CBO lays it out perfectly clear...CRYSTAL.

BTW, the CBO ALSO uses Federal Debt Held by the Public (Percentage of GDP) which is the correct construct, unless you view America as another Zimbabwe.

The chart show 2 scenarios. For all practical purposes, you can call the Extended-Baseline Scenario is the Democrat scenario and the Alternative Fiscal Scenario the Teapublican PEA BRAIN scenario.

Now that is the biggest load of bullshit I've ever seem posted on this board that this pinhead wants readers to take seriously....

The Extended-Baseline Scenario adheres closely to current law. Under this scenario, the expiration of the tax cuts enacted since 2001 and most recently extended in 2010, the growing reach of the alternative minimum tax, the tax provisions of the recent health care legislation, and the way in which the tax system interacts with economic growth would result in steadily higher revenues relative to GDP.

The Alternative Fiscal Scenario

The budget outlook is much bleaker under the alternative fiscal scenario, which incorporates several changes to current law that are widely expected to occur or that would modify some provisions of law that might be difficult to sustain for a long period. Most important are the assumptions about revenues: that the tax cuts enacted since 2001 and extended most recently in 2010 will be extended; that the reach of the alternative minimum tax will be restrained to stay close to its historical extent; and that over the longer run, tax law will evolve further so that revenues remain near their historical average of 18 percent of GDP. This scenario also incorporates assumptions that Medicare’s payment rates for physicians will remain at current levels (rather than declining by about a third, as under current law) and that some policies enacted in the March 2010 health care legislation to restrain growth in federal health care spending will not continue in effect after 2021.

IRONY...The Republicans want the budget to be balanced by keeping spending down rather than by raising tax revenues. They thus propose limiting spending to no more than 18% of gross domestic product (GDP).

The Teabagger party of PEA brains...

CBO’s projections in most of this report understate the

severity of the long-term budget problem because they do

not incorporate the negative effects that additional federal

debt would have on the economy, nor do they include the

impact of higher tax rates on people’s incentives to work

and save.

In particular, large budget deficits and growing

debt would reduce national saving, leading to higher

interest rates, more borrowing from abroad, and less

domestic investment—which in turn would lower

income growth in the United States.

Taking those effects

into account, CBO estimates that under the extendedbaseline

scenario, real (inflation-adjusted) gross national

product (GNP) would be reduced slightly by 2025 and

by as much as 2 percent by 2035, compared with what

it would be under the stable economic environment

that underlies most of the projections in this report.3

Under the alternative fiscal scenario, real GNP would be

2 percent to 6 percent lower in 2025, and 7 percent to

18 percent lower in 2035, than under a stable economic

environment.

Rising levels of debt also would have other negative

consequences that are not incorporated in those estimated

effects on output:

�� Higher levels of debt imply higher interest payments

on that debt, which would eventually require either

higher taxes or a reduction in government benefits and

services.

Rising debt would increasingly restrict policymakers’

ability to use tax and spending policies to respond to

unexpected challenges, such as economic downturns

or financial crises. As a result, the effects of such developments

on the economy and people’s well-being

could be worse.

Now tell us peabrain, what party is hellbent on REDUCING the debt......CUTTING GOVERNMENT SPENDING....BORROWING LESS FROM ABROAD.....NOT RAISING TAX RATES

Bfgrn

New member

apparently you are not done embarrassing yourself....

AGAIN moron... why aren't you using CURRENT numbers???

http://www.treasurydirect.gov/NP/BPD...application=np

Current public debt is over 9.7 Trillion

Current TOTAL debt is over $14.3 Trillion

GDP last year was about $14.5 Trillion

TOTAL debt is the proper construct you moron as it is WHAT WE OWE IN TOTAL.

But even if you wish to play the 'debt held by public', the CURRENT percentage is over 68%.... FAR above the average of 43% you tout.

I posted: CBO’s 2011 Long-Term Budget Outlook

Bfgrn

New member

CBO’s projections in most of this report understate the

severity of the long-term budget problem because they do

not incorporate the negative effects that additional federal

debt would have on the economy, nor do they include the

impact of higher tax rates on people’s incentives to work

and save.

In particular, large budget deficits and growing

debt would reduce national saving, leading to higher

interest rates, more borrowing from abroad, and less

domestic investment—which in turn would lower

income growth in the United States.

Taking those effects

into account, CBO estimates that under the extendedbaseline

scenario, real (inflation-adjusted) gross national

product (GNP) would be reduced slightly by 2025 and

by as much as 2 percent by 2035, compared with what

it would be under the stable economic environment

that underlies most of the projections in this report.3

Under the alternative fiscal scenario, real GNP would be

2 percent to 6 percent lower in 2025, and 7 percent to

18 percent lower in 2035, than under a stable economic

environment.

Rising levels of debt also would have other negative

consequences that are not incorporated in those estimated

effects on output:

�� Higher levels of debt imply higher interest payments

on that debt, which would eventually require either

higher taxes or a reduction in government benefits and

services.

Rising debt would increasingly restrict policymakers’

ability to use tax and spending policies to respond to

unexpected challenges, such as economic downturns

or financial crises. As a result, the effects of such developments

on the economy and people’s well-being

could be worse.

Now tell us peabrain, what party is hellbent on REDUCING the debt......CUTTING GOVERNMENT SPENDING....BORROWING LESS FROM ABROAD.....NOT RAISING TAX RATES

Hey PEA Brain...the Democrats have ALREADY put in place policies and laws that will reduce the debt. If WE DO NOTHING it will follow the Extended-Baseline Scenario. If Republicans get their way it will follow the Alternative Fiscal Scenario.

Maybe that tack hammer you took to the forehead split your PEA...

Mere parsimony is not economy. Expense, and great expense, may be an essential part in true economy.

Edmund Burke

Last edited:

Cancel 2016.2

The Almighty

I posted: CBO’s 2011 Long-Term Budget Outlook

Moron.... WHAT is the CURRENT percentage for Public debt to GDP? Is it 68% or is it 'below the average of 43%' like you originally claimed?

Moron... the PROPER construct is to use TOTAL debt, not just debt held by public. Unless of course you don't think we need to pay SS, Medicare, Medicaid etc....

Of course you will once again ignore the above.... won't you moron?

Cancel 2016.2

The Almighty

Hey pea brain...you can't invent a cliff, say we're on the edge of it and expect everyone to jump.

Here is the precipice we are NOT on...

Still no explanation for your use of outdated data?

Cancel 2016.2

The Almighty

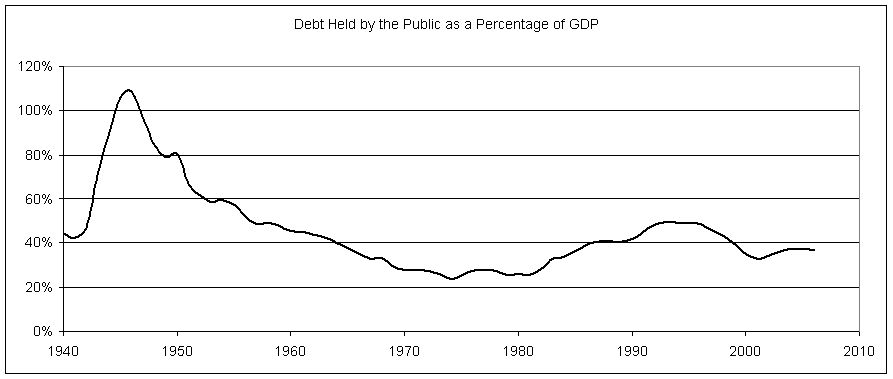

NO, my chart shows the debt held by the public as a percentage of GDP, going back to 1940. Your chart show gross debt. Debt held by the public as a percentage of GDP is the proper construct. Gross debt is not.

But even gross debt is not what is was in 1946.

MYTH: The federal debt ratio is at record levels.

Fact: Economic growth has reduced the debt ratio below the historical average.

In 2008, America’s $5.4 trillion public debt represents 38 percent of its $14.3 trillion GDP. Despite all the hand-wringing over increased budget deficits, the 38 percent debt ratio is below the post-World War II average of 43 percent. Consequently, America’s debt burden is, in fact, low by historical standards. In fact, the current 38 percent debt ratio is below the ratio at any point during the 1990s. There is no mystery to why the debt ratio has dropped so much since World War II: Economic growth has dwarfed the rate of new debt issuance. Since 1946, inflation-adjusted debt has grown by 114 percent, but the economy has grown by 532 percent—nearly five times as rapidly.

Still believe the bolded portion moron?

DamnYankee

Loyal to the end

Yeah, outside of my home mortgage debt and auto debt. I'm pretty much debt free.

What middle aged man isn't?

What middle aged man isn't?

I only have a mortgage debt...car is payed for and I pay my CC debt every month- I guess I am sitting prettier then you middle aged men folk

Bfgrn

New member

Moron.... WHAT is the CURRENT percentage for Public debt to GDP? Is it 68% or is it 'below the average of 43%' like you originally claimed?

Moron... the PROPER construct is to use TOTAL debt, not just debt held by public. Unless of course you don't think we need to pay SS, Medicare, Medicaid etc....

Of course you will once again ignore the above.... won't you moron?

Hey...Mr. Einstein economics...educate yourself...

Debt held by the public consists of promises to repay individuals and institutions, at home and abroad, who have loaned the federal government money to finance deficits. Gross debt (as the term is used in the United States) includes, along with debt held by the public, intragovernmental debt — money that one part of the federal government owes to another — such as the money the Social Security Trust Funds have lent to the Treasury in years when their earmarked revenues exceeded their expenditures for benefits and other costs.

Economists Agree Debt Held by the Public Is Proper Target

The United States faces a serious long-term fiscal problem. Large current deficits, which are the unavoidable result of the deep recession and necessary efforts to shore up the financial system and pull the country out of the downturn, are not the problem. But future deficits are projected to spiral out of control, eventually reaching unsustainable levels. Unless changes are made in current policies, deficits and debt will grow in coming decades to levels that most economists agree will have significant negative effects on the economy.

To deal with this challenge in a sensible way, it is important to focus on the true nature of the problem and how to measure it.

Most economists agree that the debt held by the public is what really affects the economy. As the Congressional Budget Office stated in its June 2009 report on the long-term budget outlook, “Long-term projections of federal debt held by the public, measured relative to the size of the economy, provide useful yardsticks for assessing the sustainability of fiscal policies.” In contrast, “gross debt . . . is not useful for assessing how the Treasury’s operations affect the economy.” [1]

A number of organizations and individuals concerned about the effect of rising deficits and debt on the budget and the economy — the Congressional Budget Office, the Government Accountability Office, the Committee on the Fiscal Future of the United States of the National Research Council and the National Academy of Public Administration, the Peterson-Pew Commission on Budget Reform, fiscal experts Alan Auerbach and William Gale, as well as the Center on Budget and Policy Priorities — have produced detailed assessments of the long-term fiscal problem facing the United States. [2] Every one of those studies focuses on debt held by the public. Every one concludes that federal debt will grow under current policies to levels that will be harmful to the economy. The decision to focus those studies on debt held by the public clearly does not arise from an effort by the authors to minimize the long-term problem the nation faces.

Debt held by the public is important because it reflects the extent to which the government goes into private credit markets to borrow. Such borrowing draws on private national saving and international saving and therefore competes with investment in the nongovernmental sector (for factories and equipment, research and development, housing, and so forth). Large increases in such borrowing can also push up interest rates and increase the future interest payments the federal government must make to foreign lenders, which reduces Americans’ income. By contrast, intragovernmental debt (the other component of the gross debt) has no such effects because it is simply money the federal government owes (and pays interest on) to itself.

Gross Debt Is Not a Reliable Indicator of Policies’ Fiscal Impact

Two examples clearly show that changes in the level of gross debt do not provide a reliable indicator of the real fiscal impact of the policies that produce those changes.

Budget analysts agree that reductions in scheduled Social Security benefits or increases in Social Security taxes would improve the federal government’s long-term fiscal outlook. But such reductions would not reduce the projected gross debt. Debt held by the public would decline because total deficits would be lower, but the reduction in Social Security benefits or increases in Social Security taxes would also increase the surplus of Social Security income over Social Security benefit payments. That would mean that the debt holdings of the Social Security Trust Funds (intragovernmental debt) would increase by an amount equal to the reduction in borrowing from the public. Gross debt would remain unchanged despite the clear improvement in the fiscal outlook.

_________________

Significance of Debt Held by Social Insurance Trust Funds

Although debt held by the public is the relevant concept for economic analysis, debt held by social insurance trust funds, such as Social Security, is important for budgetary purposes. When payroll taxes and other income of the trust fund exceed the amount needed to pay benefits and administrative expenses (as has been the case for Social Security since 1984), the surplus is credited to the trust fund and invested in special Treasury securities.a The balances in the trust fund provide legal authority to pay Social Security benefits when the Social Security program’s current income is insufficient by itself. If the trust fund becomes exhausted, benefit payments must be reduced to the level that incoming tax revenues can support. According to the latest projections of the Social Security trustees, this would occur in 2037 unless policymakers take corrective action.b

Debt held by the public represents money that must be borrowed and periodically refinanced in private credit markets; interest payments on that debt represent a current drain on government resources. If the specter of excessive debt led investors to lose confidence in U.S. government securities, federal interest costs could increase substantially, with potentially troubling implications for U.S. and world economies.

Debt held by social insurance trust funds, however, has no such economic significance. Since it does not need to be financed in credit markets, it cannot lead to a refinancing crisis. As legal authority to spend money in the future, it is essentially similar to legal authority to meet spending commitments for other entitlement programs that are not financed through trust funds and are not included in measures of federal debt. In addition, an increase in trust fund balances that provides authority for higher expenditures in some distant year is not at all equivalent to issuing more publicly held debt to finance additional spending today. If additional spending authority leads to more federal borrowing at some time in the future, that borrowing will add to debt held by the public when that spending occurs.

_________________

a These securities, known as the Government Accounts Series, carry a market interest rate but are distinct from the marketable bills, notes, and bonds sold to the public to raise cash.

b The 2009 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds, May 2009.

Conversely, there is agreement that simple accounting changes in trust funds — for instance, transfers from the general fund to a trust fund when there are no new revenues to fund such a transfer — do not affect the real fiscal outlook. To take an extreme example, simply eliminating all trust funds without changing promised benefits for the associated programs would not improve the long-term fiscal outlook at all. Yet doing so would dramatically reduce gross debt. If we passed a law today doing away with all trust funds, the gross debt would suddenly fall from 90 percent of gross domestic product (GDP) to 59 percent of GDP, but we would be facing precisely the same dire long-term fiscal problem. (See box.) This example also illustrates the problem of comparing the so-called gross debt of the United States with the gross debt of other countries that finance their social insurance programs on a pure pay-as-you-go basis. Our fiscal situation is not worse than theirs just because we use a trust-fund system to account for those programs and they do not.

More

DamnYankee

Loyal to the end

damn Yankey is clinging to the falacy that he's middle aged, I guess he plans to live to be 124.

Personally I passed middle age a long time ago, pre computers

I have longevity in my family, and unlike you I take care of myself and have remained happily married to the same gal, so yes I plan on skiing black diamond runs when I'm 100.

I have longevity in my family, and unlike you I take care of myself and have remained happily married to the same gal, so yes I plan on skiing black diamond runs when I'm 100.

Well, since I am one of the few on here that know what you actually look like, AND what your actual age is...I can attest to you being fit and that your wife is a natural beauty!

Cancel 2016.2

The Almighty

Hey...Mr. Einstein economics...educate yourself...

Debt held by the public consists of promises to repay individuals and institutions, at home and abroad, who have loaned the federal government money to finance deficits. Gross debt (as the term is used in the United States) includes, along with debt held by the public, intragovernmental debt — money that one part of the federal government owes to another — such as the money the Social Security Trust Funds have lent to the Treasury in years when their earmarked revenues exceeded their expenditures for benefits and other costs.

Economists Agree Debt Held by the Public Is Proper Target

The United States faces a serious long-term fiscal problem. Large current deficits, which are the unavoidable result of the deep recession and necessary efforts to shore up the financial system and pull the country out of the downturn, are not the problem. But future deficits are projected to spiral out of control, eventually reaching unsustainable levels. Unless changes are made in current policies, deficits and debt will grow in coming decades to levels that most economists agree will have significant negative effects on the economy.

To deal with this challenge in a sensible way, it is important to focus on the true nature of the problem and how to measure it.

Most economists agree that the debt held by the public is what really affects the economy. As the Congressional Budget Office stated in its June 2009 report on the long-term budget outlook, “Long-term projections of federal debt held by the public, measured relative to the size of the economy, provide useful yardsticks for assessing the sustainability of fiscal policies.” In contrast, “gross debt . . . is not useful for assessing how the Treasury’s operations affect the economy.” [1]

A number of organizations and individuals concerned about the effect of rising deficits and debt on the budget and the economy — the Congressional Budget Office, the Government Accountability Office, the Committee on the Fiscal Future of the United States of the National Research Council and the National Academy of Public Administration, the Peterson-Pew Commission on Budget Reform, fiscal experts Alan Auerbach and William Gale, as well as the Center on Budget and Policy Priorities — have produced detailed assessments of the long-term fiscal problem facing the United States. [2] Every one of those studies focuses on debt held by the public. Every one concludes that federal debt will grow under current policies to levels that will be harmful to the economy. The decision to focus those studies on debt held by the public clearly does not arise from an effort by the authors to minimize the long-term problem the nation faces.

Debt held by the public is important because it reflects the extent to which the government goes into private credit markets to borrow. Such borrowing draws on private national saving and international saving and therefore competes with investment in the nongovernmental sector (for factories and equipment, research and development, housing, and so forth). Large increases in such borrowing can also push up interest rates and increase the future interest payments the federal government must make to foreign lenders, which reduces Americans’ income. By contrast, intragovernmental debt (the other component of the gross debt) has no such effects because it is simply money the federal government owes (and pays interest on) to itself.

Gross Debt Is Not a Reliable Indicator of Policies’ Fiscal Impact

Two examples clearly show that changes in the level of gross debt do not provide a reliable indicator of the real fiscal impact of the policies that produce those changes.

Budget analysts agree that reductions in scheduled Social Security benefits or increases in Social Security taxes would improve the federal government’s long-term fiscal outlook. But such reductions would not reduce the projected gross debt. Debt held by the public would decline because total deficits would be lower, but the reduction in Social Security benefits or increases in Social Security taxes would also increase the surplus of Social Security income over Social Security benefit payments. That would mean that the debt holdings of the Social Security Trust Funds (intragovernmental debt) would increase by an amount equal to the reduction in borrowing from the public. Gross debt would remain unchanged despite the clear improvement in the fiscal outlook.

_________________

Significance of Debt Held by Social Insurance Trust Funds

Although debt held by the public is the relevant concept for economic analysis, debt held by social insurance trust funds, such as Social Security, is important for budgetary purposes. When payroll taxes and other income of the trust fund exceed the amount needed to pay benefits and administrative expenses (as has been the case for Social Security since 1984), the surplus is credited to the trust fund and invested in special Treasury securities.a The balances in the trust fund provide legal authority to pay Social Security benefits when the Social Security program’s current income is insufficient by itself. If the trust fund becomes exhausted, benefit payments must be reduced to the level that incoming tax revenues can support. According to the latest projections of the Social Security trustees, this would occur in 2037 unless policymakers take corrective action.b

Debt held by the public represents money that must be borrowed and periodically refinanced in private credit markets; interest payments on that debt represent a current drain on government resources. If the specter of excessive debt led investors to lose confidence in U.S. government securities, federal interest costs could increase substantially, with potentially troubling implications for U.S. and world economies.

Debt held by social insurance trust funds, however, has no such economic significance. Since it does not need to be financed in credit markets, it cannot lead to a refinancing crisis. As legal authority to spend money in the future, it is essentially similar to legal authority to meet spending commitments for other entitlement programs that are not financed through trust funds and are not included in measures of federal debt. In addition, an increase in trust fund balances that provides authority for higher expenditures in some distant year is not at all equivalent to issuing more publicly held debt to finance additional spending today. If additional spending authority leads to more federal borrowing at some time in the future, that borrowing will add to debt held by the public when that spending occurs.

_________________

a These securities, known as the Government Accounts Series, carry a market interest rate but are distinct from the marketable bills, notes, and bonds sold to the public to raise cash.

b The 2009 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds, May 2009.

Conversely, there is agreement that simple accounting changes in trust funds — for instance, transfers from the general fund to a trust fund when there are no new revenues to fund such a transfer — do not affect the real fiscal outlook. To take an extreme example, simply eliminating all trust funds without changing promised benefits for the associated programs would not improve the long-term fiscal outlook at all. Yet doing so would dramatically reduce gross debt. If we passed a law today doing away with all trust funds, the gross debt would suddenly fall from 90 percent of gross domestic product (GDP) to 59 percent of GDP, but we would be facing precisely the same dire long-term fiscal problem. (See box.) This example also illustrates the problem of comparing the so-called gross debt of the United States with the gross debt of other countries that finance their social insurance programs on a pure pay-as-you-go basis. Our fiscal situation is not worse than theirs just because we use a trust-fund system to account for those programs and they do not.

More

Ah yes, he continues to once again cower from the questions posed to him.

IS the current debt held by public under 43% or not moron?

I am not referring to interest rate risk moron, I am referring to the amount of DEBT we have to REPAY. The intergovernmental debt is COMING DUE moron.... you see, those baby boomers just keep on getting older and requiring more and more money to pay their SS/Medicare/Medicaid.

So again moron... ARE you suggesting we simply don't need to pay them because 'some economists' don't look at that debt in terms of refi risks?

Again moron... 68% and 98%.... that is the percent of GDP for debt held by public and total debt respectively.

Now, are YOU ever going to acknowledge that or are you going to continue posting meaningless links to articles to which you clearly have no comprehension?

DamnYankee

Loyal to the end

I only have a mortgage debt...car is payed for and I pay my CC debt every month- I guess I am sitting prettier then you middle aged men folk

Good for you. Unless there are extenuating circumstances it is not smart to take out a car loan at our age. I have one (nearly paid off) for mine because I use it for business and my account says its a good deal for me. We got one for my wife's because it's at 0%. For my wife and kids cars though we paid cash.

DamnYankee

Loyal to the end

Well, since I am one of the few on here that know what you actually look like, AND what your actual age is...I can attest to you being fit and that your wife is a natural beauty!