Bfgrn

New member

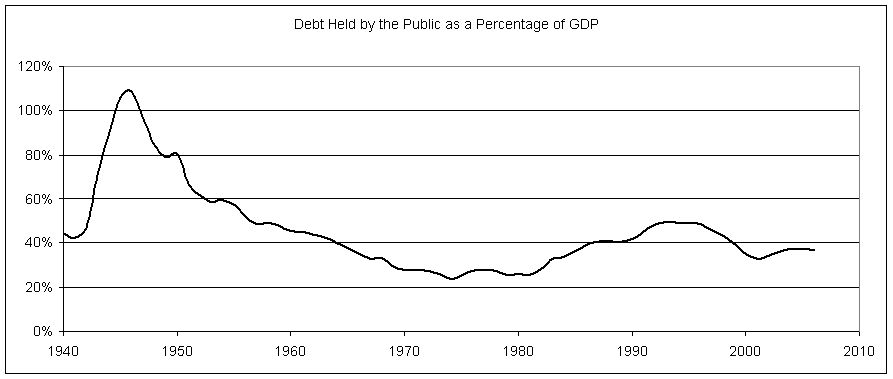

What neither side seems to recognize — or at least acknowledge — is that what matters about the debt isn’t the dollar amount per se, but how much it costs us to service it. And by that measure, the debt isn’t nearly as big a problem as it’s being made out to be.

Yes, the federal debt has grown by nearly $3 trillion dollars in the past three years. And yes, the dollar amount of that debt is quite large (in excess of $14 trillion and headed toward $15 trillion should the ceiling be raised). But large numbers are not the problem. The U.S. has a large economy (slightly larger than that debt number). And, crucially, we have very low interest rates.

Because of those low rates, the amount the U.S. government pays to service its debt is, relative to the size of the economy, less than it was paying throughout the boom years of the 1980s and 1990s and for most of the last decade. The Congressional Budget Office estimates that net interest on the debt (which is what the government pays to service it) would be $225 billion for fiscal year 2011. The latest figures put that a bit higher, so let’s call it $250 billion. That’s about 1.6% of American output, which is lower than at any point since the 1970s – except for 2003 through 2005, when it was closer to 1.4%.

Under Ronald Reagan, the first George Bush, and Bill Clinton, payments on federal debt often got above 3% of GDP. Under Bush the second, payments were about where they are now. Yet suddenly, we are in a near collective hysteria.

The U.S. Is Not Drowning In Debt | Moneyland | TIME.com

Yes, the federal debt has grown by nearly $3 trillion dollars in the past three years. And yes, the dollar amount of that debt is quite large (in excess of $14 trillion and headed toward $15 trillion should the ceiling be raised). But large numbers are not the problem. The U.S. has a large economy (slightly larger than that debt number). And, crucially, we have very low interest rates.

Because of those low rates, the amount the U.S. government pays to service its debt is, relative to the size of the economy, less than it was paying throughout the boom years of the 1980s and 1990s and for most of the last decade. The Congressional Budget Office estimates that net interest on the debt (which is what the government pays to service it) would be $225 billion for fiscal year 2011. The latest figures put that a bit higher, so let’s call it $250 billion. That’s about 1.6% of American output, which is lower than at any point since the 1970s – except for 2003 through 2005, when it was closer to 1.4%.

Under Ronald Reagan, the first George Bush, and Bill Clinton, payments on federal debt often got above 3% of GDP. Under Bush the second, payments were about where they are now. Yet suddenly, we are in a near collective hysteria.

The U.S. Is Not Drowning In Debt | Moneyland | TIME.com