Minnesota’s Fraud Problem Isn’t Immigrants NOT TRUE THEY HAVE BEEN TAUGHT TO BE CRIMINALS AND EEXPECT EVERYTHING FOR FREE.

It’s the vast size of the welfare state that corrupts them.

Wall Street Journal, By

The Editorial BoJan. 2, 2026 5:29 pm ET

Republicans are having a field day with Minnesota’s welfare fraud, and understandably so. But while Gov. Tim Walz and Somali migrants may be easy political targets, the GOP will let this scandal go to waste if it fails to explain how

vast government welfare payments have become an invitation for fraud and abuse.

The Trump Health and Human Services Department Tuesday said it is suspending federal child-care payments to Minnesota after a social-media personality claimed day-care centers run by Somali residents committed up to $100 million in fraud. That assertion hasn’t been corroborated, and over-egging fraud claims won’t help reform.

But Minnesota’s varieties of government fraud are prompting welcome scrutiny of its welfare system. Visitors to the state government website could mistake it for an internet scam because it advertises so many handouts—cash, housing support, child care, food, emergency assistance and more. These are on top of federal transfer payments.

Herewith a partial menu of what Minnesota residents can get from the state:

•

Cash payments. Minnesota offers a “working families” tax credit of up to $3,089 a year, which operates similar to the federal earned income tax credit (maximum of $8,046). Both credits phase out as incomes rise. Minnesotans can also claim a $1,750 refundable tax credit for each child, on top of the $2,200 federal credit. That’s $4,000 per kid.

Low-income Minnesotans can also qualify for a

preloaded debit card to pay for incidental expenses. A single unemployed parent with two children can get $1,189 a month in additional cash payments. Minnesotans who work can get more cash, but the work incentive is undermined by the state’s other payments that phase out as paychecks grow.

The state also operates a cash-grant program for low-income families who face evictions, utility shutoffs or other “household emergencies.”

Forgot to pay rent or the gas bill? The state has you covered.

Once upon a time, the

safety net was intended to help the disabled and sick who can’t support themselves—

not for those who choose not to work, which is what it has become. Two distinct Social Security programs support people with disabilities (which can include depression and ADHD) and those with disabled children, though

these have also been abused.

•

Healthcare. Minnesota was a pioneer in using federal Medicaid dollars to pay for other forms of social assistance such as housing, which is the locus of several fraud schemes. Two dozen states, including many run by Republicans, now tap Medicaid to pay nonprofits to provide housing “support” for the homeless or addicts.

Minnesota also operates a

quasi-public health insurance option funded by ObamaCare subsidies. Rather than directly subsidize insurers, the feds send money to the state to manage its public option. Private insurers have a

financial incentive to police fraud by providers. Government not so much.

•

Food. The U.S. Department of Agriculture operates 16 “nutrition assistance programs,” with the biggest being SNAP, aka food stamps. About 41.6 million Americans, i

ncluding 450,000 Minnesotans, receive food stamps averaging $186 a month. Because many states have eased eligibility verifications, people often receive more than they’re entitled to. The nationwide overpayment rate in 2024 was 9.3%, though somewhat lower in Minnesota (6.3%).

Minnesota is also one of nine or so states that provide free breakfasts and lunches to all students no matter their family income. In the

pandemic Minnesota paid nonprofits to feed children. Much of this school lunch money was stolen, say federal indictments.

•

Housing. The Department of Housing and Urban Development doles out some $60 billion each year to states and localities to subsidize rent for low-income households. In

Minneapolis, low-income folks can receive $1,257 a month to rent a one-bedroom apartment. Rent subsidies phase out as incomes rise.

•

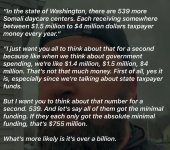

Child care.

Minnesota provides heavily subsidized child care for low-income families, partly funded by the feds.

State subsidies are paid directly to child-care providers, which could enable fraudsters to set up fly-by-night day care to bilk the government. Parents can also claim up to $2,100 a year in federal tax credits for day care.

•

Paid leave. Minnesota lets workers take up to 20 weeks of paid family and medical leave a year if they earned at least $3,900 in the prior year. The

entitlement is funded by a 0.88 percentage-point payroll tax. A worker who earned $4,000 in a year can receive as much as $5,538 in paid leave, according to a state calculator.

***

With so much money and so many programs, this vast system is an open vault for scammers—especially when

politicians are loathe to police fraud because doing so might be called “racist” or “anti-poor.” But it’s also corrupting for beneficiaries who have an incentive to remain on the dole rather than build an independent life.

Republicans complain about fraud, but too few want to tackle the perverse incentives that allow it to flourish. Annual government transfer payments have increased by some $1.7 trillion to $4.9 trillion since the start of the pandemic, roughly double the rate of inflation. Minnesota’s problem isn’t immigrants. It’s the welfare state that corrupts them.

Minnesota’s Fraud Problem Isn’t Immigrants

It’s the vast size of the welfare state that corrupts them.