This is what the EU says:

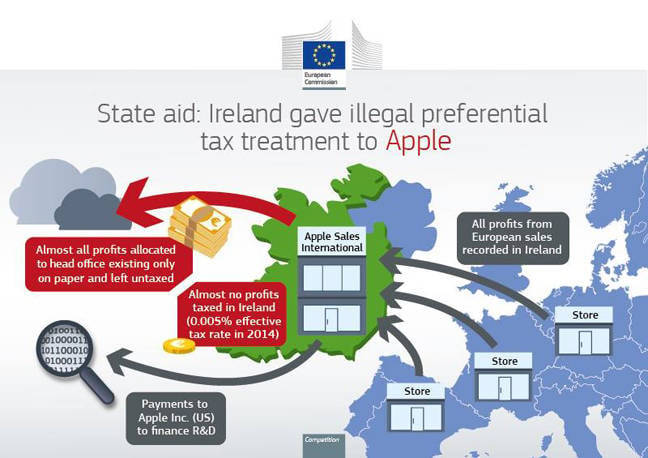

Apple Inc., which is based in California, set up two companies in Ireland: Apple Sales International and Apple Operations Europe. According to the European Commission, these companies had no employees or real offices but still realized large profits. Apple paid virtually no tax to Ireland, or to any country, on these profits because of a former law in Ireland. In the last year that the law was in effect, 2015, Apple Sales International paid just 0.005% tax, according to the commission.

The European Commission is led by Margrethe Vestager, a member of Denmark's social liberal party. The commission is not a tax authority; instead, its job is to maintain fairness between the EU member states. And that brings us to the most important part in this story: The commission says this law specifically favored Apple for special treatment.

When Apple sold iPhones, iPads, and Macs in an EU single-market nation, such as France, the commission said Apple would funnel the profits from France to Ireland and would not pay tax in either country. But this is not really about Apple's tax-avoidance strategies, which are infamous.

The European Commission's issue is really not with Apple but with Ireland.

Aid versus tax

How's this for a tricky balancing act?

EU leaders have no issue with different member nations charging different corporate-tax rates. That's why it's acceptable for Ireland to charge businesses a 12.5% income tax whereas France levies 33.3%.

More @ source

Apple Inc., which is based in California, set up two companies in Ireland: Apple Sales International and Apple Operations Europe. According to the European Commission, these companies had no employees or real offices but still realized large profits. Apple paid virtually no tax to Ireland, or to any country, on these profits because of a former law in Ireland. In the last year that the law was in effect, 2015, Apple Sales International paid just 0.005% tax, according to the commission.

The European Commission is led by Margrethe Vestager, a member of Denmark's social liberal party. The commission is not a tax authority; instead, its job is to maintain fairness between the EU member states. And that brings us to the most important part in this story: The commission says this law specifically favored Apple for special treatment.

When Apple sold iPhones, iPads, and Macs in an EU single-market nation, such as France, the commission said Apple would funnel the profits from France to Ireland and would not pay tax in either country. But this is not really about Apple's tax-avoidance strategies, which are infamous.

The European Commission's issue is really not with Apple but with Ireland.

Aid versus tax

How's this for a tricky balancing act?

EU leaders have no issue with different member nations charging different corporate-tax rates. That's why it's acceptable for Ireland to charge businesses a 12.5% income tax whereas France levies 33.3%.

More @ source