http://m.nbcnews.com/business/economywatch/jobs-data-shows-economy-still-fighting-shape-1C7488578

Lowest unemployment rate in 4 years. 4 years ago GWB was president.

Lowest unemployment rate in 4 years. 4 years ago GWB was president.

Unemployment Plunges to 3.8% for Government Workers; Government Adds 35,000 Jobs in November, 544,000 Since July

so basically, the stats look good, but it's going to kill the economy in the long run.

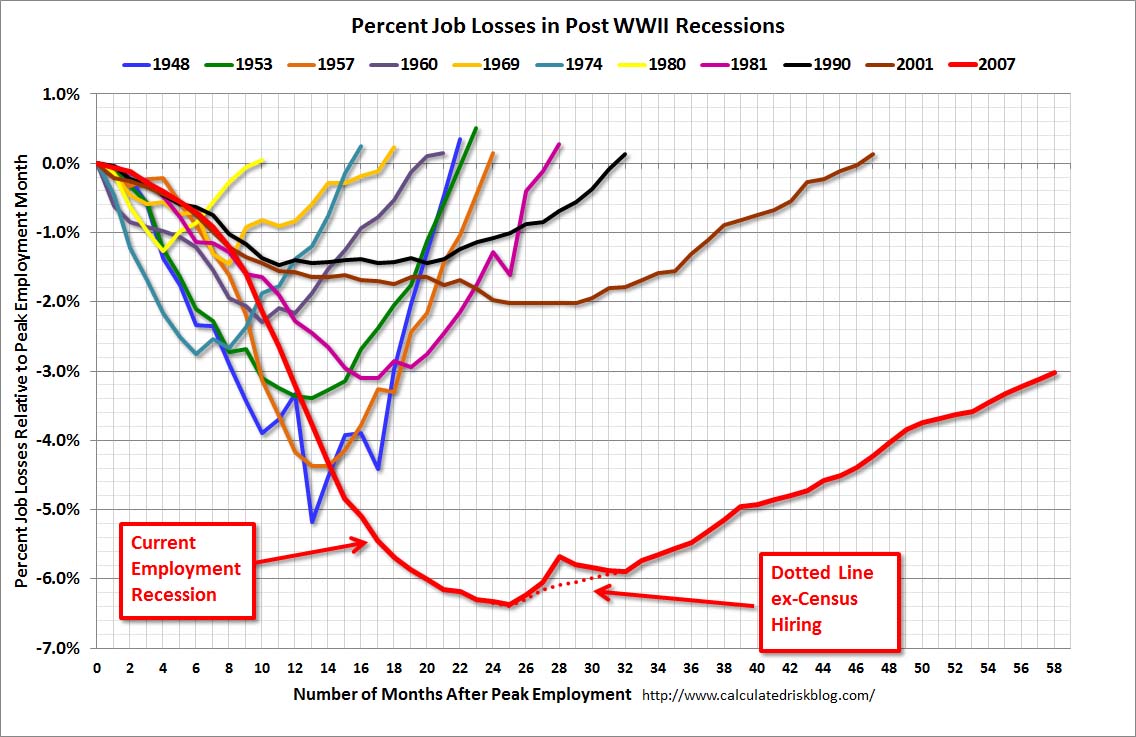

7.7 is still pretty shitty the far out from the end of the actual recession:

Just heard Jim Cramer interviewed on the Today Show (I feel the need to state for the record I do not watch the Today Show but the Misses has it on in her room so I heard this when I walked in there) and he claimed this was unmitigated good news and that we are having a mini boom in job creation.

Doesn't this graph rather contradict Keynesian economic theory that Government should increase hiring during a recesion?Here's government employment since Obama took office:

How the fuck can they continue to have that guy on TV considering what he did during the credit default swap drevitive crises where Cramer was encouraging investment in banks loaded with these toxic assets. Cramer either did that knowing he was scaming people into investing in these toxic stocks or he's flat out incompetent. I seriously doubt that it's the later.Just heard Jim Cramer interviewed on the Today Show (I feel the need to state for the record I do not watch the Today Show but the Misses has it on in her room so I heard this when I walked in there) and he claimed this was unmitigated good news and that we are having a mini boom in job creation.

Doesn't this graph rather contradict Keynesian economic theory that Government should increase hiring during a recesion?

How the fuck can they continue to have that guy on TV considering what he did during the credit default swap drevitive crises where Cramer was encouraging investment in banks loaded with these toxic assets. Cramer either did that knowing he was scaming people into investing in these toxic stocks or he's flat out incompetent. I seriously doubt that it's the later.

http://m.nbcnews.com/business/economywatch/jobs-data-shows-economy-still-fighting-shape-1C7488578

Lowest unemployment rate in 4 years. 4 years ago GWB was president.

Sorry, I should have stated my question more clearly. I should have asked "Doesn't this graph indicate that "this administrations actions" rather contradict Keynesian economic theory..........?"It actually can support Keynesian theory. Keynesians would say that we have a weak recovery because the government, instead of increasing consumption of goods and services as it should do during a recession to bring about a robust recovery, has actually acted as a further drag on demand by decreasing consumption of goods and services.

Well they are all probably hanging out at your Trailer Park, so you should be in a position to know.Yes, awesome news. 540,000 people dropped out of the work force. You must be proud

Sorry, I should have stated my question more clearly. I should have asked "Doesn't this graph indicate that "this administrations actions" rather contradict Keynesian economic theory..........?"

Gotcha.....and local government employment is heavily dependent on State funding. So in other words, at the Federal level, Keynesian principles were applied but were to little to be very affective but were probably as much as the administration could obtain under the circumstances?Federal government employment has been about flat overall. The real losses are at the state and local level, which the stimulus bill tried to address with state and local aid. The problem was that it wasn't enough and efforts to increase state and local aid failed. Here's state and local government employment since January 2009:

The red line is local government employment. Blue line is state.

Doesn't this graph rather contradict Keynesian economic theory that Government should increase hiring during a recesion?

I agree with you in principle with sime minor exceptions. We haven't really been Keynesians since the 70's. Supply side theory has dominated since about 1980. I'd also say we've been ignoring infrastructure for about the last 30 years or longer too.It does. It is one of the reasons I've said here that Obama is no Keynesian. Another is the way "stimulus" was spent mainly on things other than infrastructure. Most notably, the absence of shovel-ready jobs that he kept promising then joked about later during a jobs conference.

I'm hoping the jobs come back regardless of policy. Growth is what will bring the revenues that can bring us out of this mess, if we stop them from overspending. During good times Keynesian policy tells us to pay down the debt, we haven't been Keynesian in the US or largely in Europe, since 1960...

We should have been upgrading our electric grid, we should have been rebuilding bridges, we should have been burying electric lines so that snowstorms and hurricanes don't kill all our power... We should have been throwing everything, yes even solar, at getting off the foreign energy teat rather than ignoring coal and natural gas...

The inability of a longer view from our politicians has been incredibly disappointing to me.

i thought there was an earthquake.

There was. Northern Japan. It wasn't 7.7 though.i thought there was an earthquake.