G

Guns Guns Guns

Guest

Through 2008, the top one-in-a-thousand taxpayers had average income in recent years that ranged between $5.2 million and $7.5 million annually.

Just investing that much in corporate bonds will produce enough interest income to keep someone in the top 1 percent.

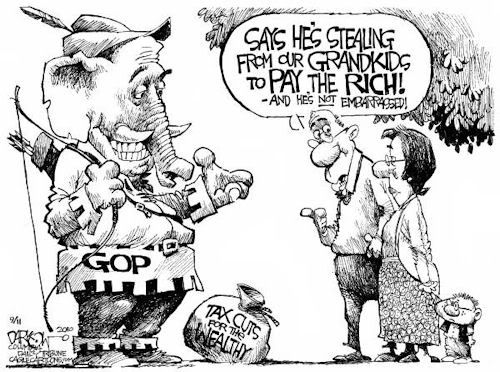

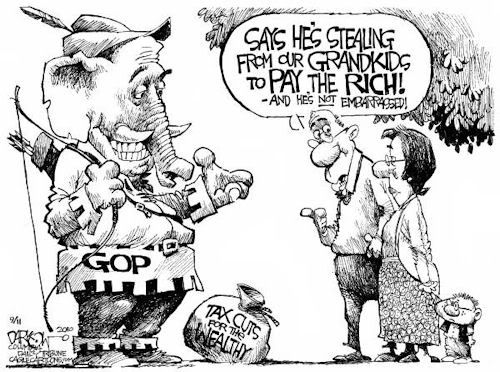

Furthermore, inside the top 1 percent, those with the highest incomes pay the lowest tax rates.

The top 1 percent paid an average income tax rate of 24 percent in 2009, IRS data shows.

The top 400 taxpayers paid a much lower rate.

On an average income of $270 million each, their effective federal income tax rate was 18.1 percent in 2008, the latest year for which we have IRS data.

A single worker earning less than $90,000 pays a higher rate than that.

http://blogs.reuters.com/david-cay-johnston/2011/10/25/beyond-the-1-percent/

Just investing that much in corporate bonds will produce enough interest income to keep someone in the top 1 percent.

Furthermore, inside the top 1 percent, those with the highest incomes pay the lowest tax rates.

The top 1 percent paid an average income tax rate of 24 percent in 2009, IRS data shows.

The top 400 taxpayers paid a much lower rate.

On an average income of $270 million each, their effective federal income tax rate was 18.1 percent in 2008, the latest year for which we have IRS data.

A single worker earning less than $90,000 pays a higher rate than that.

http://blogs.reuters.com/david-cay-johnston/2011/10/25/beyond-the-1-percent/