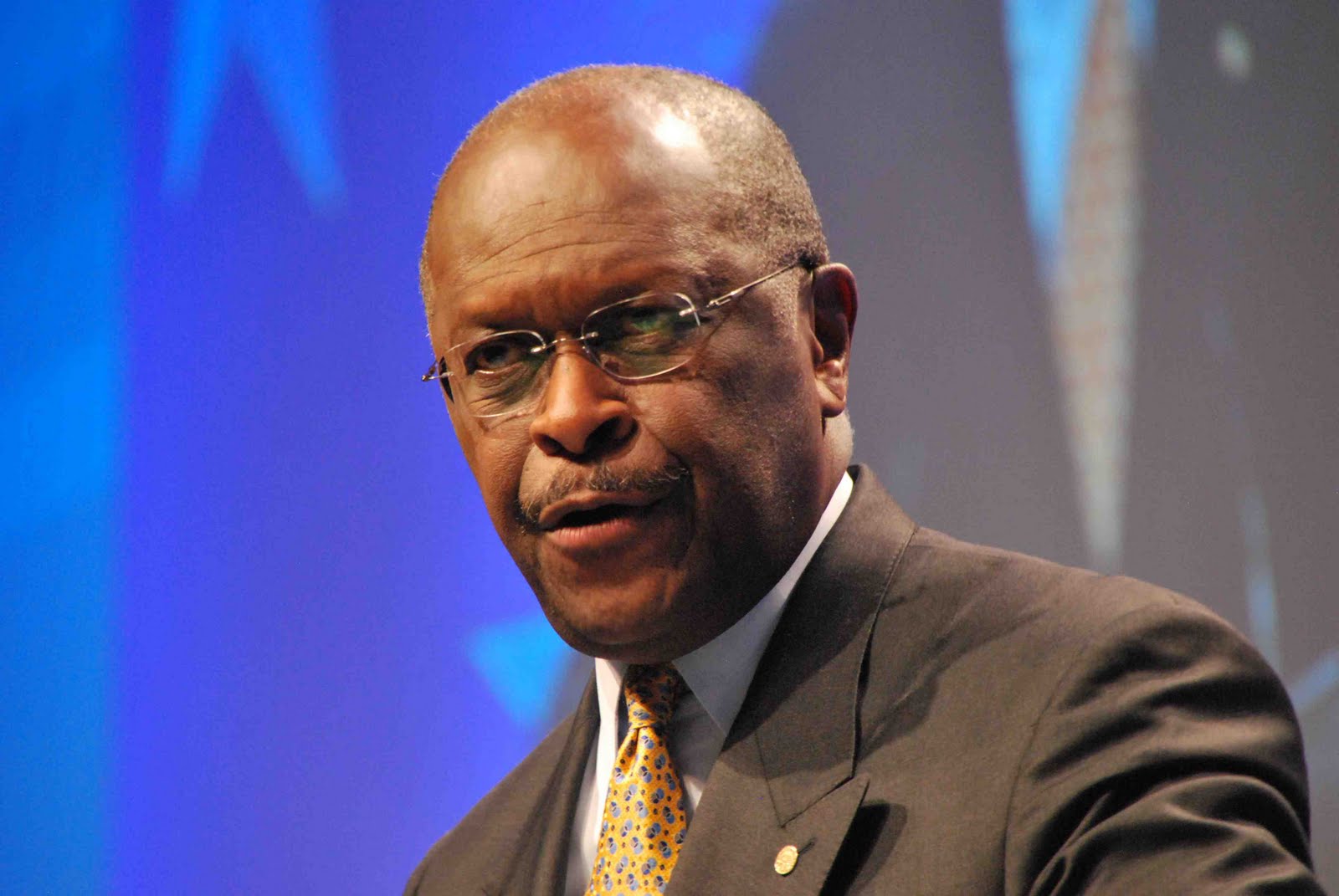

I am a fan of Herman Cain. But there is a tidbit that may screw him royally.

From:

http://motherjones.com/politics/2011/05/herman-cain-aquila-lawsuit-2012

"Founded in 1917 as Green Light and Power, Aquila traditionally made its money operating electric and gas plants and selling the energy they produced. In the years after Cain joined the board, Aquila's earnings climbed, from $254 million in 1995 to $351 million in 1998. Then, in early 1999, the company's leadership decided running power plants wasn't lucrative enough; energy trading and speculation had grown popular, and as the class suit lays out, Aquila wanted a piece of the action.

It was a dangerous move—as a company spokesman later put it, "the risk was huge." In the end, it proved disastrous. Aquila's decision to join Enron, Reliant Energy, and the other heavy-hitters in the energy trading markets would ultimately wipe out 94 percent of Aquila's stock value between 1999 and 2004. The company also faced criticism for using some of the same trading tricks that Enron did as a way to puff up its stock price, the lawsuit says. That included using "roundtrip" trades, a scheme in which Aquila would sell a trading partner some energy and then that partner would sell the same amount back to Aquila, a deal that canceled itself out. In the end, nothing actually changed hands. But it boosted Aquila's trading volume and revenue, sending a positive signal to the markets. The company also engaged in megawatt laundering, or "ricochet" trading, the lawsuit alleges. In such transactions, Aquila and other companies would buy energy from California at a lower capped price, move that energy out of the state, then re-sell it back to California at a higher price for a tidy profit.

But this financial trickery couldn't save a listing ship. In 2002, Aquila teetered on the brink of collapse. And for Aquila's employees, the result of the company's foray into energy trading was devastating: The company's employee retirement fund, overseen by the board of directors, lost more than $200 million in 2002. The reason: At the same time Aquila's executives and directors were investing more and more in highly risky energy speculation, they were selling their employees on the conservative nature of Aquila and pushing them to invest their retirement savings in company stock.

For years, the lawsuit says, executives urged employees in company speeches to reinvest in Aquila, lauded those who did so as "Aquila partners," and even offered a 15 percent discount to buy company stock. Executives and board members also made it more difficult to sell off company stock by implementing lock-up periods, during which employees couldn't cash in their holdings. At the end of 2000, 85 percent of Aquila employees owned common stock in the company. What's more, 60 percent of the employees' retirement fund consisted of Aquila stock—even though financial experts say that total should never be more than 10 to 20 percent."

More at the link.