Nothing for debate, just facts FYI.....

The gutter politics of the Dems is alive and well this election season...Scumbag Democrat Party unleash the IRS and Justice on donors to their political opponents.

http://online.wsj.com/article/SB100...70151720874.html?mod=WSJ_hpp_sections_opinion

If at first you don't succeed, get some friends in high places to shut your opponents up. That's the latest Washington power play, as Democrats and liberals attack the Chamber of Commerce and independent spending groups in an attempt to stop businesses from participating in politics.

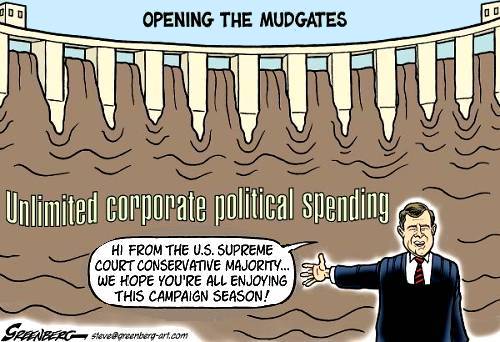

Since the Supreme Court's January decision in Citizens United v. FEC, Democrats in Congress have been trying to pass legislation to repeal the First Amendment for business, though not for unions. Having failed on that score, they're now turning to legal and political threats. Funny how all of this outrage never surfaced when the likes of Peter Lewis of Progressive insurance and George Soros helped to make Democrats financially dominant in 2006 and 2008.

The gutter politics of the Dems is alive and well this election season...Scumbag Democrat Party unleash the IRS and Justice on donors to their political opponents.

http://online.wsj.com/article/SB100...70151720874.html?mod=WSJ_hpp_sections_opinion

If at first you don't succeed, get some friends in high places to shut your opponents up. That's the latest Washington power play, as Democrats and liberals attack the Chamber of Commerce and independent spending groups in an attempt to stop businesses from participating in politics.

Since the Supreme Court's January decision in Citizens United v. FEC, Democrats in Congress have been trying to pass legislation to repeal the First Amendment for business, though not for unions. Having failed on that score, they're now turning to legal and political threats. Funny how all of this outrage never surfaced when the likes of Peter Lewis of Progressive insurance and George Soros helped to make Democrats financially dominant in 2006 and 2008.