StormX

Banned

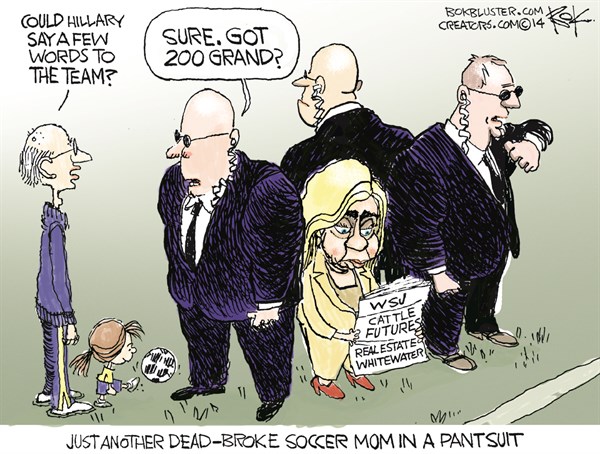

[h=1]Clintons' $35 MILLION from the finance sector for speeches - before she turned on Wall Street[/h]

In the 18 months prior to announcing her second campaign for president, the front-runner for the Democratic nomination addressed private equity investors in California and New York, delivered remarks to bankers in Hilton Head, South Carolina, and spoke to brokers at the Ritz-Carlton in Naples, Florida.

Her efforts capped a nearly 15-year period in which Clinton and her husband, former President Bill Clinton, made at least $35 million by giving 164 speeches to financial services, real estate and insurance companies after leaving the White House in 2001, according to an Associated Press analysis of public disclosure forms and records released by her campaign.

The bulk of the Clintons' paid speeches to the financial industry came after the 2008 economic crash. From 2009 to 2014, the couple made $26 million from 109 appearances sponsored by banks, insurance companies, hedge funds, private equity firms and real estate businesses, and at those industries' conferences and before their trade organizations.

With Hillary Clinton serving as secretary of state for most of that period, her husband brought in the bulk of the money, nearly $17 million. That included $250,000 Bill Clinton earned for mingling with investment managers in New York on May 12 — thirty days after she released a video announcing her second bid for the White House.

Advocates for boosting financial regulation say the large personal payouts underscore a political imperative for Clinton to take tough policy positions.

'She needs to show that she is not too cozy with the banks, and that makes it even more important for her to draw a clear line and propose very tough measures,' said Robert Reich, a secretary of labor during the Clinton administration who has advised Hillary Clinton's campaign.

Exactly what the Clintons said in their speeches is hard to find. Although many of the remarks were given to large groups, reporters were typically barred. Often, Hillary Clinton's contract expressly prohibited the remarks from being broadcast, transcribed or 'otherwise reproduced,' according a copy of her agreement for one speech with the University of Buffalo.

Still, some details have trickled out.

Beyond the personal income, Clinton also has close political ties to the finance industry. Over the course of her career, from her 2000 run for the Senate to the two presidential campaigns, people working in the finance, insurance and real estate industries have given her campaigns about $35 million — more than donors from any other lines of work, according to the Center for Responsive Politics.

Her top two contributors over those years were employees from Citigroup and Goldman Sachs, the center found.

Since her husband left the White House, the family's charity, the Clinton Foundation, has collected millions more from the industry, with companies such as Barclay's, Citigroup, Fidelity, HSBC and Goldman Sachs listed as donating as much as $5 million each.

In public remarks, Clinton casts herself as having offered a major rebuke of the industry in 2007, before the economic downturn that led to the Great Recession. 'I went to Wall Street in December of 2007 — before the big crash that we had — and I basically said, 'Cut it out!'' she said in this year's first Democratic primary debate.

But while she suggested steps to regulate the industry in that 2007 speech, she was careful to strike a more balanced tone, saying 'there's plenty of blame to go around.'

Less than a year later, she backed the $700 billion bank stabilization plan, known as TARP, to bail out the industry in the midst of the financial crisis — a bill Sanders voted against.

'In fairness, not many in politics were on top of the issue,' said Brad Miller, a Democratic former North Carolina congressman and an advocate of tougher financial regulation. 'No one knew the effects of the bad mortgages on the financial system. I certainly didn't.'

Both Sanders and former Maryland Gov. Martin O'Malley, another Democratic rival, support reinstating the law that once separated commercial and investment banking. Known as Glass-Steagall, it was repealed in 1999 during her husband's administration.

While Clinton doesn't rule out breaking up the big banks, she argues that restoring Glass-Steagall wouldn't go far enough to curb risk. Instead, she would impose a graduated fee on large financial firms that would increase as companies hold greater amounts of debt, to discourage excessive risk.

Read more: http://www.dailymail.co.uk/news/art...d-35M-financial-businesses.html#ixzz3sSOYkQSJ

Follow us: @MailOnline on Twitter | DailyMail on Facebook

They don't donate money unless their is something in it for them.....they expect something in return on their investment.

- The Clintons gave 164 speeches before Wall Street crowds, racking in $35 million, since leaving the White House in 2001

- Democratic rival Bernie Sanders has blasted Hillary Clinton for being too cozy with the financial sector

- The majority of Hillary Clinton's paid speeches to the financial sector came after the 2008 crash

In the 18 months prior to announcing her second campaign for president, the front-runner for the Democratic nomination addressed private equity investors in California and New York, delivered remarks to bankers in Hilton Head, South Carolina, and spoke to brokers at the Ritz-Carlton in Naples, Florida.

Her efforts capped a nearly 15-year period in which Clinton and her husband, former President Bill Clinton, made at least $35 million by giving 164 speeches to financial services, real estate and insurance companies after leaving the White House in 2001, according to an Associated Press analysis of public disclosure forms and records released by her campaign.

With Hillary Clinton serving as secretary of state for most of that period, her husband brought in the bulk of the money, nearly $17 million. That included $250,000 Bill Clinton earned for mingling with investment managers in New York on May 12 — thirty days after she released a video announcing her second bid for the White House.

Advocates for boosting financial regulation say the large personal payouts underscore a political imperative for Clinton to take tough policy positions.

'She needs to show that she is not too cozy with the banks, and that makes it even more important for her to draw a clear line and propose very tough measures,' said Robert Reich, a secretary of labor during the Clinton administration who has advised Hillary Clinton's campaign.

Exactly what the Clintons said in their speeches is hard to find. Although many of the remarks were given to large groups, reporters were typically barred. Often, Hillary Clinton's contract expressly prohibited the remarks from being broadcast, transcribed or 'otherwise reproduced,' according a copy of her agreement for one speech with the University of Buffalo.

Still, some details have trickled out.

Beyond the personal income, Clinton also has close political ties to the finance industry. Over the course of her career, from her 2000 run for the Senate to the two presidential campaigns, people working in the finance, insurance and real estate industries have given her campaigns about $35 million — more than donors from any other lines of work, according to the Center for Responsive Politics.

Her top two contributors over those years were employees from Citigroup and Goldman Sachs, the center found.

Since her husband left the White House, the family's charity, the Clinton Foundation, has collected millions more from the industry, with companies such as Barclay's, Citigroup, Fidelity, HSBC and Goldman Sachs listed as donating as much as $5 million each.

In public remarks, Clinton casts herself as having offered a major rebuke of the industry in 2007, before the economic downturn that led to the Great Recession. 'I went to Wall Street in December of 2007 — before the big crash that we had — and I basically said, 'Cut it out!'' she said in this year's first Democratic primary debate.

But while she suggested steps to regulate the industry in that 2007 speech, she was careful to strike a more balanced tone, saying 'there's plenty of blame to go around.'

Less than a year later, she backed the $700 billion bank stabilization plan, known as TARP, to bail out the industry in the midst of the financial crisis — a bill Sanders voted against.

'In fairness, not many in politics were on top of the issue,' said Brad Miller, a Democratic former North Carolina congressman and an advocate of tougher financial regulation. 'No one knew the effects of the bad mortgages on the financial system. I certainly didn't.'

Both Sanders and former Maryland Gov. Martin O'Malley, another Democratic rival, support reinstating the law that once separated commercial and investment banking. Known as Glass-Steagall, it was repealed in 1999 during her husband's administration.

While Clinton doesn't rule out breaking up the big banks, she argues that restoring Glass-Steagall wouldn't go far enough to curb risk. Instead, she would impose a graduated fee on large financial firms that would increase as companies hold greater amounts of debt, to discourage excessive risk.

Read more: http://www.dailymail.co.uk/news/art...d-35M-financial-businesses.html#ixzz3sSOYkQSJ

Follow us: @MailOnline on Twitter | DailyMail on Facebook