serendipity

Verified User

.

I certainly hope this is not the case but fear for the worst.

A top asset management firm has warned China's economic crisis is going to "get much worse."

Hayman Capital founder Kyle Bass has warned that President Xi's over reliance on real estate has sent its economy tumbling toward 2008-era financial conditions.

It comes as Chinese markets have suffered a $7 trillion fallout since 2021. Over the last few months, Beijing authorities have publicised efforts to stem these outflows, though confidence has yet to pick up.

This is just like the US financial crisis on steroids.

"They have three and a half times more banking leverage than we did going into the crisis. And they've only been at this banking thing for a couple of decades."

He said that the years of double-digit growth China enjoyed prior to the pandemic were made possible by an unregulated real estate market, adding that the market was leaning too heavily on debt to expand.

He said: "The basic architecture of the Chinese economy is broken."

LATEST DEVELOPMENTS

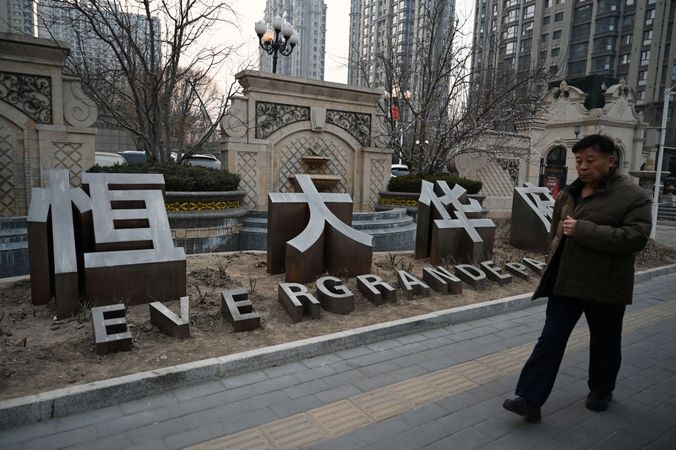

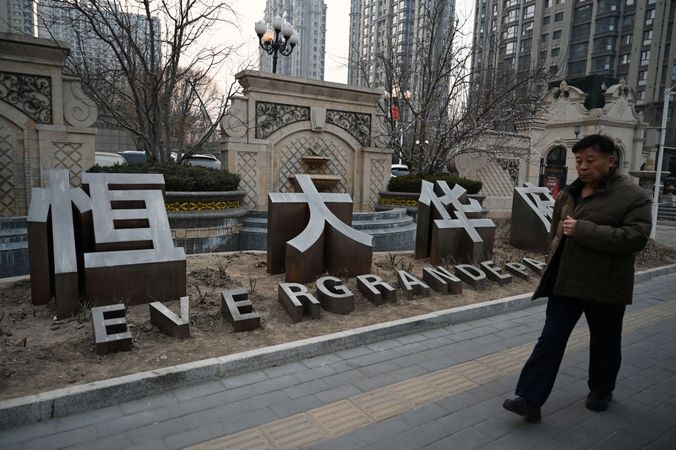

A Hong Kong court on January 29 ordered the liquidation of China's property giant Evergrande

https://www.gbnews.com/news/world/china-economic-collapse-2008-global-crash-steroids

I certainly hope this is not the case but fear for the worst.

A top asset management firm has warned China's economic crisis is going to "get much worse."

Hayman Capital founder Kyle Bass has warned that President Xi's over reliance on real estate has sent its economy tumbling toward 2008-era financial conditions.

It comes as Chinese markets have suffered a $7 trillion fallout since 2021. Over the last few months, Beijing authorities have publicised efforts to stem these outflows, though confidence has yet to pick up.

This is just like the US financial crisis on steroids.

"They have three and a half times more banking leverage than we did going into the crisis. And they've only been at this banking thing for a couple of decades."

He said that the years of double-digit growth China enjoyed prior to the pandemic were made possible by an unregulated real estate market, adding that the market was leaning too heavily on debt to expand.

He said: "The basic architecture of the Chinese economy is broken."

LATEST DEVELOPMENTS

A Hong Kong court on January 29 ordered the liquidation of China's property giant Evergrande

https://www.gbnews.com/news/world/china-economic-collapse-2008-global-crash-steroids

Last edited: