鬼百合

不给糖就捣蛋

California to negotiate trade with other countries to bypass Trump tariffs

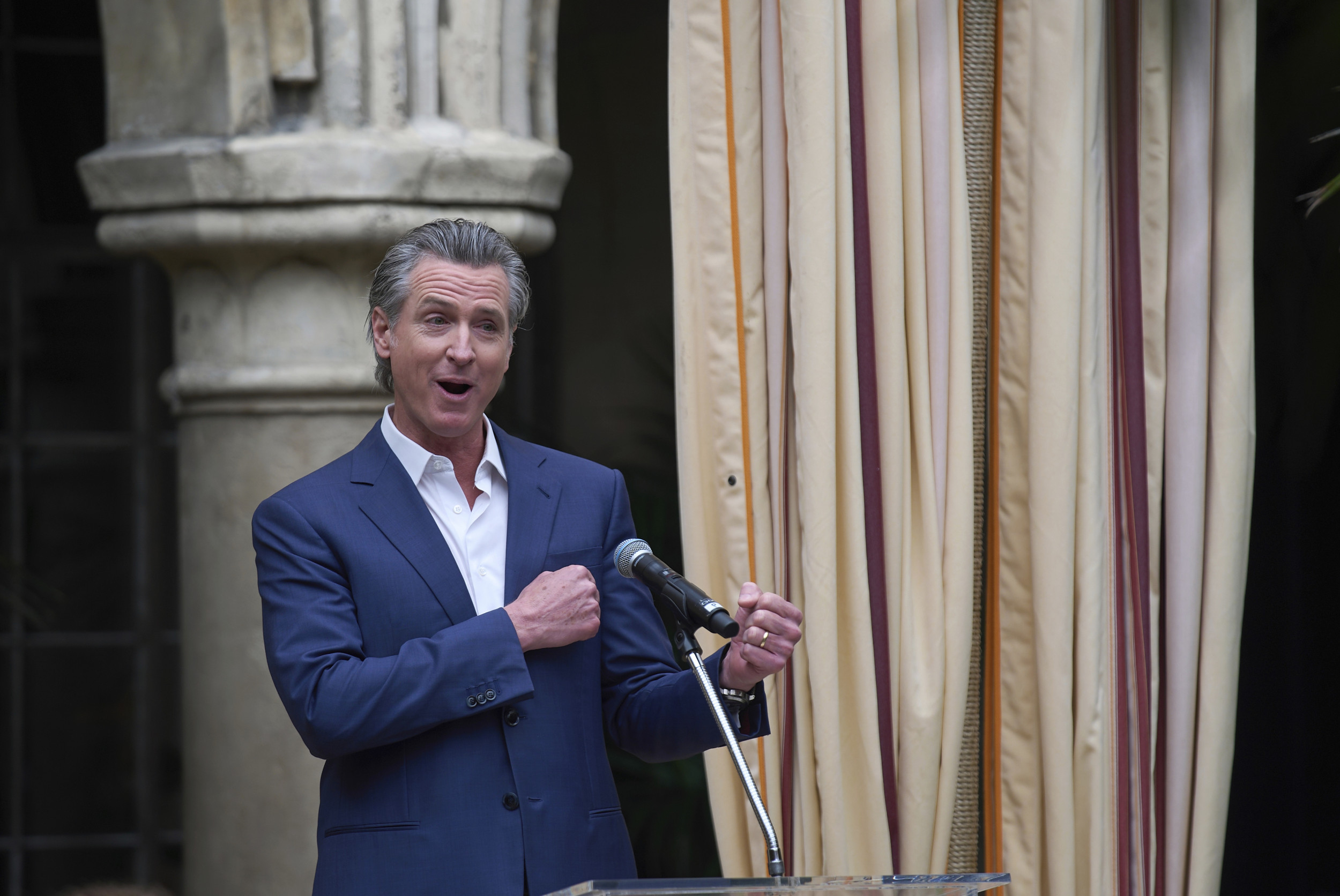

Gov. Gavin Newsom said California will look for new trade opportunities.

California Governor Gavin Newsom said he has directed his administration to "look at new opportunities to expand trade" as he tries to steer his state around President Donald Trump's sprawling import tariffs.

Why It Matters

California, the world's fifth-largest economy, plays a crucial role in driving U.S. economic growth. As the largest importer and second-largest exporter among U.S. states, with over $675 billion in two-way trade, it holds significant economic influence. Therefore, Trump's tariffs could have a major impact, potentially increasing costs for California businesses, disrupting global supply chains, and putting pressure on vital industries within the state.What To Know

In a post on X, Newsom addressed the U.S.'s global trading partners, writing "California is here and ready to talk."It comes after a Fox News report revealed that Newsom is directing his state to pursue "strategic" relationships with countries announcing retaliatory tariffs against the U.S., urging them to exclude California-made products from those taxes.

California Gov. Gavin Newsom announces "Vogue World: Hollywood" a fashion event that celebrates the conversation between film and fashion scheduled for October 2025, at a news conference at Chateau Marmont in Los Angeles, Wednesday, March... More Damian Dovarganes/AP

In response, White House spokesperson Kush Desai told Fox News: "Gavin Newsom should focus on out-of-control homelessness, crime, regulations, and unaffordability in California instead of trying his hand at international dealmaking."

On Wednesday, the White House imposed a 10 percent baseline tariff on all imports, including those from U.S. allies and non-economically active regions, along with higher rates for countries with large trade surpluses against the U.S. on Wednesday.

The tariffs include a 34 percent tax on imports from China, a 20 percent tax on imports from the European Union, 25 percent on South Korea, 24 percent on Japan and 32 percent on Taiwan. Mexico and Canada, from which most U.S. produce imports come, are exempt from Trump's latest tariffs, but the 25 percent tariffs that Trump levied on both countries last month will remain intact.

Trump's announcement sent the markets into turmoil on Thursday, with Wall Street recording its worst day since 2020, when Covid-19 was in full swing. Meanwhile, China hit back with a 34 percent retaliatory tariff on Friday, in the first signs of an all-out trade war that could cripple imports and exports. Other nations are now also mulling over retaliatory tariffs.

Amid the turmoil, the Newsom administration is concerned that retaliatory tariffs could hit California hard, with major impacts on agriculture, manufacturing, and trade

California, not being its own country, can't be directly targeted in international trade retaliation. However, countries could choose to retaliate against Trump's tariffs by targeting goods commonly produced in states other than California—like soybeans or pork—instead of products like California wine or walnuts, Daniel Sumner, an agricultural and resource economics professor at UC Davis, told Newsweek.

According to Fox News, Newsom administration officials are particularly concerned that California's almond industry, a key agricultural exporter, could lose billions of dollars, as countries like China, India, and the European Union impose retaliatory tariffs.

Almond exports were valued at $4.7 billion in 2022, supporting 110,000 jobs and contributing $9.2 billion to California's GDP. With 76 percent of the world's almonds grown in California—and most exported—trade restrictions could cost the industry up to $875 million, according to a UC Davis study.

Other food prices may also rise as a result of the tariffs. Ninety percent of avocados consumed in the U.S. come from Mexico, so restrictions could drive up prices and reduce consumption. Similarly, California milk prices could increase if tariffs make canola from Canada more expensive, forcing farmers to switch to pricier alternatives.

The wine and alcohol industries face rising costs as well. Tariffs on European wines may lead California winemakers to hike prices, while reliance on imported materials like corks, glass, and capsules from Mexico and Canada could further push prices upward.

Beyond agriculture, the state's manufacturing sector—especially in Los Angeles—is at risk. The region employed over 313,000 manufacturing workers last year and plays a central role in California's $1 trillion county economy. Economist Jock O'Connell warned that reduced imports and exports could lead to fewer jobs at ports and throughout supply chains, especially in the Inland Empire.