G

Guns Guns Guns

Guest

When Loren Snyder's debit card was damaged recently, Bank of America wanted $5 to issue a new one.

That struck Snyder, a bank customer for many years, as penny-wise and pound-foolish.

"I know the CEO has to have his summer cottage and his yacht," the 63-year-old said. "But would it hurt them to give me a new card?"

Asked how he felt about the prospect of paying B of A $5 a month to use his own money after paying another $5 for the card to do it with, Snyder, who owns a dental supply business, said, "Can I use profanity?"

Brian T. Moynihan doesn't like that kind of talk.

CEO Moynihan said he is “incensed” by the public criticism of his company.

He used the strong word — it's from the Latin for fire and means "very angry" — speaking to bank employees at the bank's Charlotte, N.C., headquarters, saying he gets "a little incensed when you think about how much good all of you do, whether it's volunteer hours, charitable giving we do, serving clients and customers well."

He went on to say to the bank's critics, "You ought to think a little about that before you start yelling at us."

If you think a little about that, you'll quickly see it's completely irrelevant. All those charitable, volunteering employees have nothing to do with what people are yelling about.

If banking had an Academy Award for disingenuousness, Moynihan would be the industry's Meryl Streep.

Yes, Bank of America branches have employees who are really nice people.

But the analysts, regulators, investors, customers and others who are "yelling" at the bank aren't yelling at its employees, they're yelling about the bank's behavior.

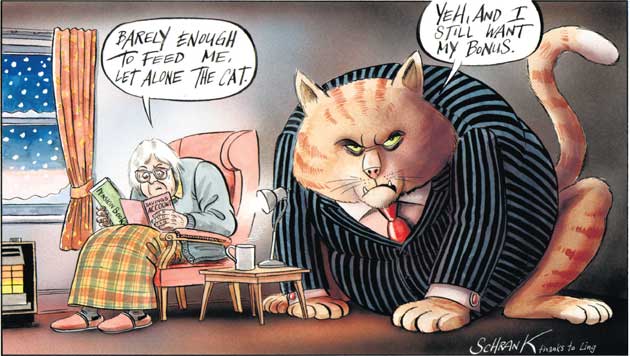

Does Moynihan think people didn't notice that the second-largest American non-oil company (after only Walmart) took $45 billion in Troubled Asset Relief Program bailout money and then announced they would charge people $5 a month to use their debit cards to access their own money?

Does Moynihan think people don't remember the bank's $50 billion "deal from hell" to buy bankruptcy-bound Merrill Lynch, and the $3.6 billion it handed out in bonuses to Merrill Lynch executives even as Merrill was reporting a loss of $27 billion for the year, and B of A was seeking more TARP money?

Maybe people didn't notice that when two of B of A's top executives, both reporting to Moynihan, were shown the door last month, their severance pay was more than $11 million.

In a J.D. Power and Associates customer satisfaction survey this month, B of A came in 24th out of 24 banks.

Consumerist.com named the bank the nation's second-worst American company of any kind.

B of A missed the gold only because of the presence of Darth Vader-ish BP on the list.

But since the "it's-not-our-fault" oil spillers are a British company, B of A could probably claim the all-American double: last in customer satisfaction and first as worst American company.

Maybe some of the people yelling want to know why, if Moynihan gets so incensed on behalf of the bank's charitable employees, he is planning to cut 30,000 of them from the payroll, as the bank announced last month.

Maybe they notice that B of A is facing skepticism from the market, anger from investors, lawsuits from its role in the mortgage debacle and a government investigation into its foreclosure practices, which have included such quirks as trying to foreclose on the wrong home.

Or that the bank has been selling off assets.

Or that its common stock has been dipping under $7 in recent days, about half its 52-week high.

Or that it's being sued by the Feds for allegedly misrepresenting the quality of mortgages it sold to Fannie Mae and Freddie Mac.

Some have even noticed that the bank claims a book value (assets minus liabilities) of more than $200 billion, although the market doesn't agree, and its actual market cap is only about $72 billion.

If I were a customer, a shareholder, or an employee — even a charitable, volunteering one — I'd be incensed.

http://www.mailtribune.com/apps/pbcs.dll/article?AID=/20111030/NEWS/110300327

[URL]http://www.politico.com/news/stories/1011/66979.html#ixzz1cFy9baSN[/URL]