Originally Posted by

Walt

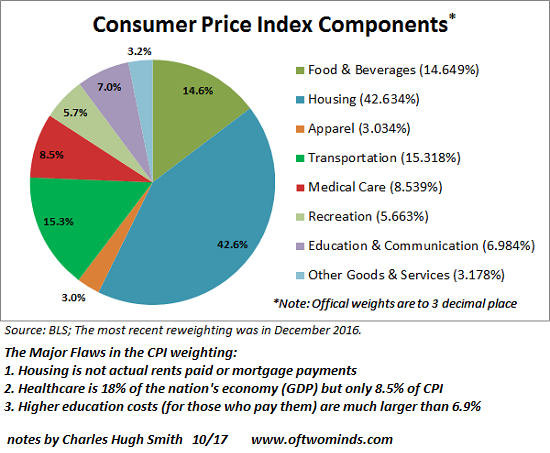

No, we cannot agree. If anything, the CPI has been proven to overstate inflation on Social Security recipients. It is targeted at urban office workers who have to buy their own houses, pay for new education, and pay for their own healthcare. Most retired people already own a house, or live in an apartment with more stable rent. They are unlikely to be taking on a new mortgage. They are even less likely to be paying for education. There are 70 year olds in college, but that is the exception, not the rule. And most importantly, Social Security recipients have Medicare, so are not paying the full force of their medical expenses.

Study after study shows that inflation on Social Security recipients is overstated, not understated... Or to be more accurate, most of the time. When inflation happens quickly, it takes Social Security a year to catch up, so we are in for a few bad months for Social Security recipients...

But there were some very good years there, where Social Security recipients got bigger increases from a year before than they were seeing when they got it. And there was even deflation where Social Security recipients did not see their Social Security checks go down.

Reply With Quote

Reply With Quote

Bookmarks