Our federal income tax rate is very progressive. And it should not be based on ability to pay but what is fair. A person should not be required to pay more because some congressman wants to keep a military base open in his district the military says is unnecessary, build a weapon system the military did not request, or pay for military ceremonies at NFL games just because he can afford to pay more.

Personal Ignore Policy PIP: I like civil discourse. I will give you all the respect in the world if you respect me. Mouth off to me, or express overt racism, you will be PERMANENTLY Ignore Listed. Zero tolerance. No exceptions. I'll never read a word you write, even if quoted by another, nor respond to you, nor participate in your threads. ... Ignore the shallow. Cherish the thoughtful. Long Live Civil Discourse, Mutual Respect, and Good Debate! ps: Feel free to adopt my PIP. It works well.

Earl (08-22-2019)

Personal Ignore Policy PIP: I like civil discourse. I will give you all the respect in the world if you respect me. Mouth off to me, or express overt racism, you will be PERMANENTLY Ignore Listed. Zero tolerance. No exceptions. I'll never read a word you write, even if quoted by another, nor respond to you, nor participate in your threads. ... Ignore the shallow. Cherish the thoughtful. Long Live Civil Discourse, Mutual Respect, and Good Debate! ps: Feel free to adopt my PIP. It works well.

"When government fears the people, there is liberty. When the people fear the government, there is tyranny."

A lie doesn't become the truth, wrong doesn't become right, and evil doesn't become good just because it is accepted by a majority.

Author: Booker T. Washington

"When government fears the people, there is liberty. When the people fear the government, there is tyranny."

A lie doesn't become the truth, wrong doesn't become right, and evil doesn't become good just because it is accepted by a majority.

Author: Booker T. Washington

"When government fears the people, there is liberty. When the people fear the government, there is tyranny."

A lie doesn't become the truth, wrong doesn't become right, and evil doesn't become good just because it is accepted by a majority.

Author: Booker T. Washington

I didn't say I objected to the concept of progressive taxation. I said it is already very progressive. The effective rate of taxes paid increases as income increases. Those in the bottom 40% pay a negative rate because they get the Earned Income Tax Credit and those at the top over 20% effective rate. Those that make more pay more which is what progressive taxes are supposed to do.

I like the simplicity of a flat tax although the rate paid by all should not start until a person makes over $40,000 or so.

Hello Flash,

Oh, OK, sort of a modified flat tax.

And no, I can't see how that would work very well at all. The rich pay much more of the revenue than the poor. What you're proposing would essentially strip away all the revenue generated by taxing the rich more than the middle. That revenue is absolutely vital for making our country great, so we can't really be great without it. We'd be quite mediocre. We would have to cut way back on government spending, which would translate into massive job loss, 2.1 million Americans employed by the government, so that would produce a lot of unemployment.

We're not collecting enough revenue as it is, which is extremely irresponsible during a strong economy, since it is impossible to increase revenue during a weak economy. Basically, the only time you can stock up on your hay reserves is while the sun is shining. That means the next recession is going to have a far greater impact on the debt than average because we didn't do that under Trump, we didn't prepare. We just spent.

Personal Ignore Policy PIP: I like civil discourse. I will give you all the respect in the world if you respect me. Mouth off to me, or express overt racism, you will be PERMANENTLY Ignore Listed. Zero tolerance. No exceptions. I'll never read a word you write, even if quoted by another, nor respond to you, nor participate in your threads. ... Ignore the shallow. Cherish the thoughtful. Long Live Civil Discourse, Mutual Respect, and Good Debate! ps: Feel free to adopt my PIP. It works well.

LV426 (08-22-2019)

lies

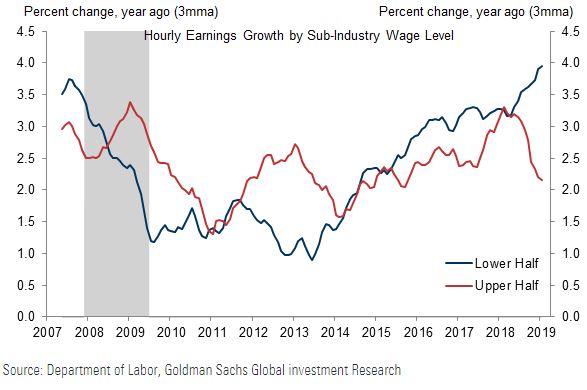

Workers at the lower end of the pay scale finally are getting the most benefit from rising wages

https://www.cnbc.com/2019/03/13/work...ing-wages.html

For the first time during the recovery, lower-end earners are getting more of the benefit, according to a Goldman Sachs report.

Flash (08-22-2019)

BECAUSE OF THE MINIMUM WAGE INCREASES YOU STUPID ASSHOLE!

Lower end of the pay scale = minimum wage

So if you increase the minimum wage, you raise wages for workers at the lower end of the pay scale.

So your shitty tax cuts didn't case any wage increases for those at the bottom, minimum wage increases did.

When I die, turn me into a brick and use me to cave in the skull of a fascist

When I die, turn me into a brick and use me to cave in the skull of a fascist

Bookmarks