I love the phased elimination of SALT.

Blue states won't get to to shift the burden of their high taxes on to the federal Treasury anymore.

I love the phased elimination of SALT.

Blue states won't get to to shift the burden of their high taxes on to the federal Treasury anymore.

So how many of you left wingers on JPP have had this happen to you this year?

If it is such a big problem, I would suspect you all are victims of it. Willing to step up and be counted?

I will understand if you won't

dukkha (02-08-2019)

PS

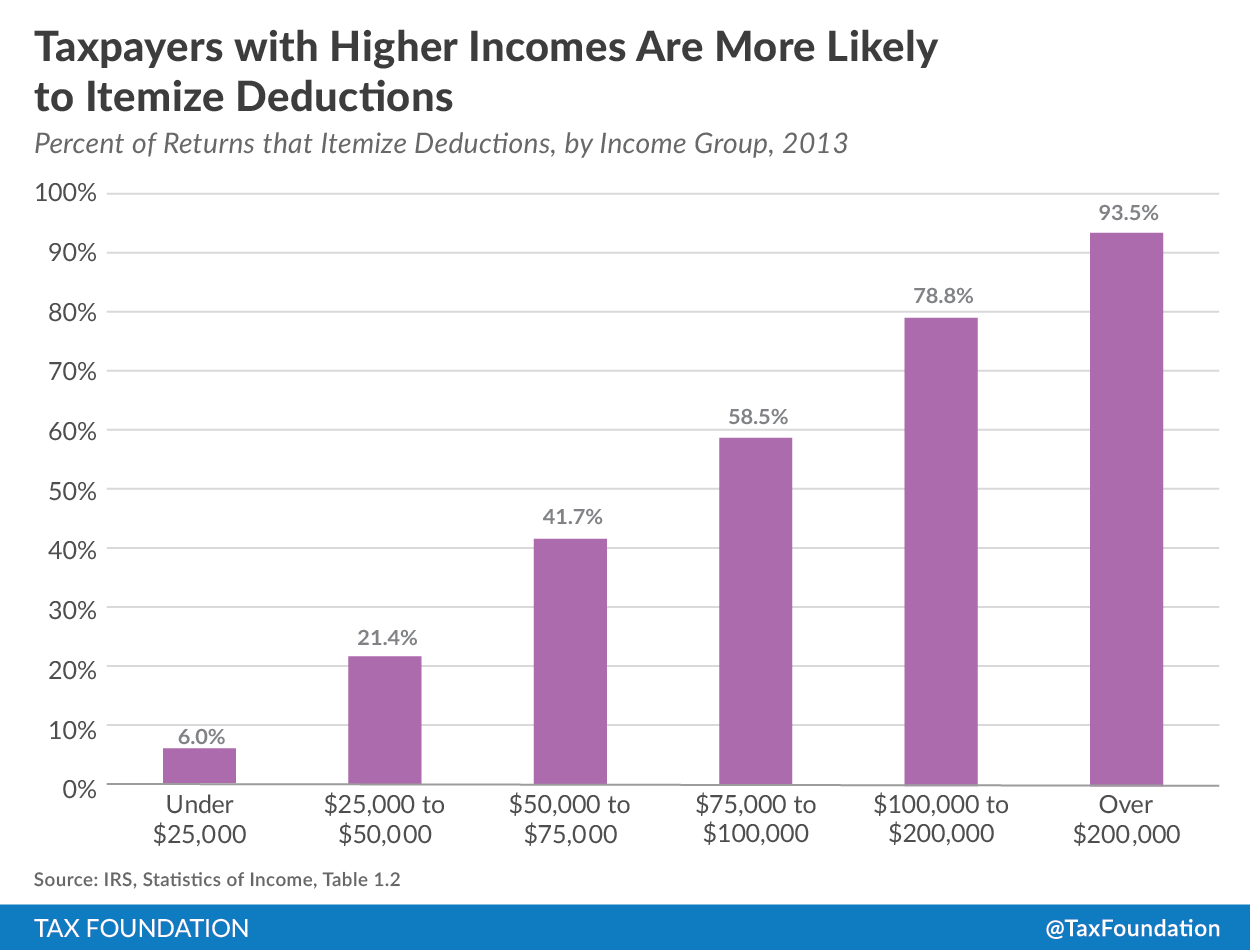

Historically those who itemized were most likely to have higher incomes for obvious reasons. The OP is not borne out by facts

Earl (02-08-2019)

Congrats on the raise. My son is president of a company with 85 employees and 50 million in revenue and his income is 500K annually...250K in salary and 250K in bonus. I asked him how he received such a high bonus and he said that he set his own bonus but that it could not be higher than his salary. True story.

The doubling of the Standard Deduction from 12K to 24K for married filing jointly will result in approximately 90% of taxpayers filing the short form. This is from FBC.

Last edited by Earl; 02-08-2019 at 10:18 AM.

dukkha (02-08-2019)

Yeah, but the OP posted a link to an OP ED and everything. They say they have done the math

Because you know people who make $50,000 a year have way more than $24,000 in itemized deductions right? I mean who doesn't?

The median home price in the US as of November 2018 is $302,400

https://www.census.gov/construction/...uspricemon.pdf

Let's assume a 30 year mortgage with 20% down at prevailing interest rates of 3.875% comes out to a mortgage payment of $1128/month with your first year total interest being $9233. Now remember, the interest deduction decreases over time as you pay down your mortgage

Let's also assume you live in a state with HIGH property taxes like New Jersey where the average annual property tax is $3,971

https://www.cbsnews.com/media/the-9-...roperty-taxes/

Thus far using MATH and easily obtainable data, we have a someone paying $13,204 in property taxes and interest on their mortgage. Now, I know it takes a special kind of genius to be a leftist, but I am pretty sure that $13,204 is much less than $24,000

That leaves $11,000 for other deductions like charity, non reimbursed business expenses and healthcare

Based on these numbers, I would suspect that the OP and his followers are completely full of shit and don't know what they are talking about. But, I don't expect them to concede as they are too steeped in their ignorance

How is someone getting stiffed when the standard deduction for a married couple with two kids going to $28,000?

Explain that? How many people do you know with deductions greater than $28,000/year that are lower middle class. I will wait while you ponder the math.

I don't expect much from you though so don't worry

wow! congrats to your son!

~~

ya. what the libs fail to understand is the rich already pay most of the taxes ( not going to look up the figures)

and if you tax them to death they will just leave the country ( like rich NE are leaving for Florida)

or simply not invest in business start ups, where their imcome tax would be 70&

Earl (02-08-2019)

here ya go stupid:

By 2027, according to the Joint Committee on Taxation, every income group below $75,000 will actually see a tax increase. Only those income ranges above $75,000 will still see a cut by 2027. And according to the Tax Policy Center, only taxpayers higher than the 90th percentile -- that is, those earning about $225,000 and above -- will have better-than-even odds of getting a tax cut in 2027.

That's a significantly different pattern than in the bill's early years.

So the tax bill -- at its start -- does come close to providing tax relief for all income groups, and for most members within each income group. But it's doesn't give a tax cut to "everybody," and by 2027, most taxpayers, including those in the "middle class," will actually be paying more than they would have under the previous law.

~ Polifact

Bookmarks