Guno צְבִי

We fight, We win, Am Yisrael Chai

Especially if Pres.Moron keeps allowing millions of disease-hazard illegals into our nation, with the taxpayers stuck with the bill for their care.

Poor whitey, the red wave was a tiny ripple

Especially if Pres.Moron keeps allowing millions of disease-hazard illegals into our nation, with the taxpayers stuck with the bill for their care.

Yawn. Seriously. YAWN. The only person that would "thank" your for this mindless drivel is obviously your inbred sibling. Guno.

Especially if Pres.Moron keeps allowing millions of disease-hazard illegals into our nation, with the taxpayers stuck with the bill for their care.

You wouldn't recognize "the truth" if you accidentally bumped into it with your nose, Asshole.

By the way, I am not collecting welfare and never have...and I am not a Democrat. Stop putting so much effort into trying to prove you are an asshole. We already know that you are.

Yawn. Frank, you can try and lie like the rest on the left here. You collect some sort of public assistance. And have. You and your type are completely incapable of making it on your own in this country. Handouts are your birthright.

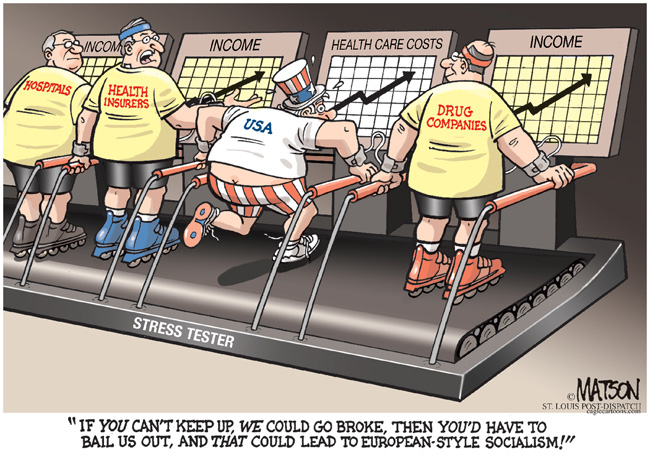

Right now according to the Kaiser Family Foundation, it costs about $22K a year to provide a worker with health insurance.

Of that $22K cost, the worker pays about $6K and the employer pays about $16K.

For a business of 50 employees, that is $800,000 a year that the company is spending on health care. Most businesses of 50 employees or less make an average income of just $53,000 a year. $800,000 spent on health care, $53,000 in profit.

Under Bernie Sanders' M4A proposal, that business of 50 employees would pay exactly $0 in taxes to provide health care for their workers, saving $800,000 a year that can be put toward employee salaries, renovations, or new hires. Bernie's plan sets a 7.5% tax on business income in excess of $100,000. Most small businesses don't even come close to making that amount of profit, and those that do are hedge funds (they get taxed separately under Bernie's proposal).

But what about the employee? Won't they have to pay too? Yes, of course. They pay 4% on income above $29,000. The average HH income in the country is about $70K, so the average amount paid by workers in taxes for single payer would be just $1,600. Remember, workers pay $6,000 for health care right now. For a worker to pay the same amount, they would have to make at least $150,000/yr. Only 10% of US workers make more than $150,000 a year.

I have fended for myself since age 17...when I enlisted in the USAF. I have never been on welfare...although I acknowledge that I did collect some unemployment for six weeks back in the 1970's or 80's. You are an asshole attempting to troll me...and doing a piss poor job of it. All I am doing is laughing at your poor attempts.

Don't be discouraged. Do keep coming back.

I enjoy the laughs more than you can imagine.

Frank. Every time you post you just scream " I am on welfare". Nice try at dodging it though. You white, woke, welfare collecting democrat.

Frank. Every time you post you just scream " I am on welfare". Nice try at dodging it though. You white, woke, welfare collecting democrat.

Right now according to the Kaiser Family Foundation, it costs about $22K a year to provide a worker with health insurance.

Of that $22K cost, the worker pays about $6K and the employer pays about $16K.

For a business of 50 employees, that is $800,000 a year that the company is spending on health care. Most businesses of 50 employees or less make an average income of just $53,000 a year. $800,000 spent on health care, $53,000 in profit.

Under Bernie Sanders' M4A proposal, that business of 50 employees would pay exactly $0 in taxes to provide health care for their workers, saving $800,000 a year that can be put toward employee salaries, renovations, or new hires. Bernie's plan sets a 7.5% tax on business income in excess of $100,000. Most small businesses don't even come close to making that amount of profit, and those that do are hedge funds (they get taxed separately under Bernie's proposal).

But what about the employee? Won't they have to pay too? Yes, of course. They pay 4% on income above $29,000. The average HH income in the country is about $70K, so the average amount paid by workers in taxes for single payer would be just $1,600. Remember, workers pay $6,000 for health care right now. For a worker to pay the same amount, they would have to make at least $150,000/yr. Only 10% of US workers make more than $150,000 a year.

When you say single payer do you mean the government being involved? Because that's not single payer.

Quote Originally Posted by floridafan View Post

We are still waiting for the "better" insurance plans that Trump promised us.

You are a fucking moron and a phony.

I am not, and never have been, on welfare.

There is no way you could know otherwise except to speculate...and I can tell you that you are lousy at speculation.

I have no idea of why you get your jollies from supposing I am on welfare, but since you apparently cannot do it the way most normal people do, go for it. It costs me nothing...and you get to have what you cannot have via normal methods.

And I get to laugh at you.

It is a win/win situation. Looking forward to more of your nonsense.

Me thinks you protest to much. Welfare boy. Go take a nap old man.

If it's one entity paying then it is quite literally SINGLE PAYER.

Doesn't matter who is administering it, it's still just one single payer for all medical claims.

It doesn't sound to me like you know what words mean.

Allow me to repeat: You are a fucking moron. Methinks is the word you were looking for. Only a fucking moron uses that archaic construct as "Me thinks."

Your problem seems to be that you do not think. I suspect that is probably because you can't think.

this is a very good example of why Democrats shouldn't be in charge of sewage plants......they don't know shit about how markets work. All they can do is centralize power, enable corruption, enrich their buddies, and rob the commoners.

What plan do you support, and why?