Yeah, but the OP posted a link to an OP ED and everything. They say they have done the math

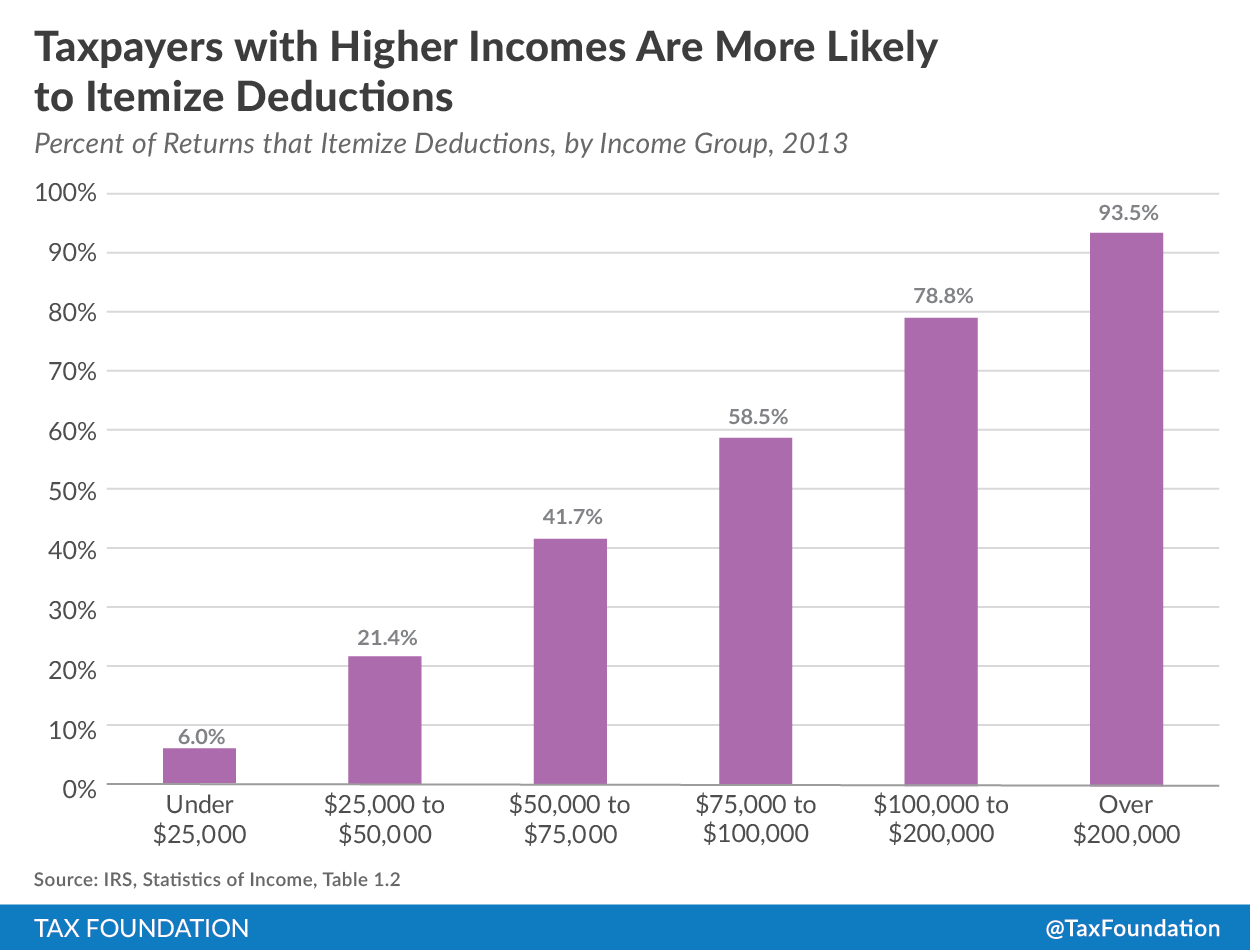

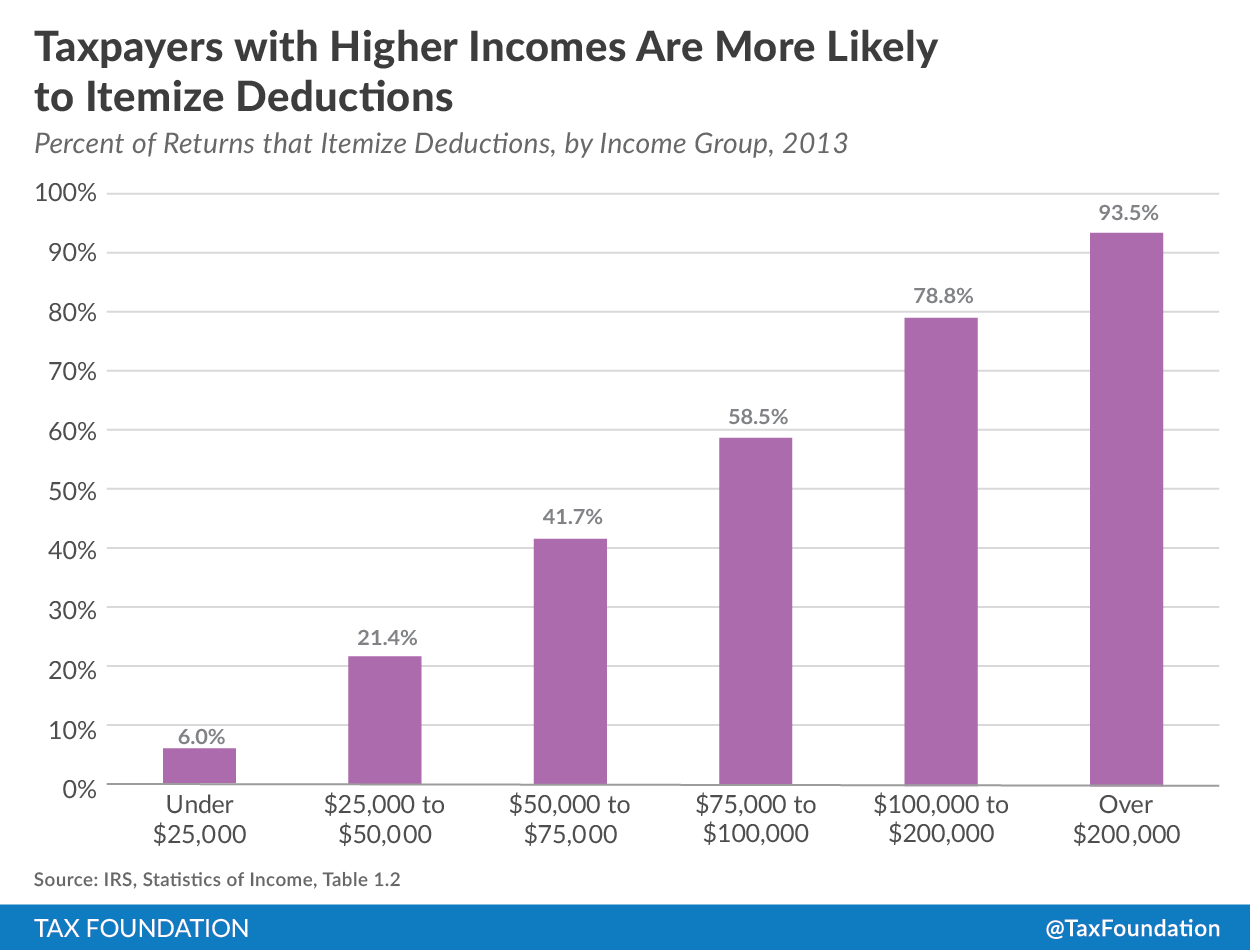

Because you know people who make $50,000 a year have way more than $24,000 in itemized deductions right? I mean who doesn't?

The median home price in the US as of November 2018 is $302,400

https://www.census.gov/construction/nrs/pdf/uspricemon.pdf

Let's assume a 30 year mortgage with 20% down at prevailing interest rates of 3.875% comes out to a mortgage payment of $1128/month with your first year total interest being $9233. Now remember, the interest deduction decreases over time as you pay down your mortgage

Let's also assume you live in a state with HIGH property taxes like New Jersey where the average annual property tax is $3,971

https://www.cbsnews.com/media/the-9-states-with-the-highest-property-taxes/

Thus far using MATH and easily obtainable data, we have a someone paying $13,204 in property taxes and interest on their mortgage. Now, I know it takes a special kind of genius to be a leftist, but I am pretty sure that $13,204 is much less than $24,000

That leaves $11,000 for other deductions like charity, non reimbursed business expenses and healthcare

Based on these numbers, I would suspect that the OP and his followers are completely full of shit and don't know what they are talking about. But, I don't expect them to concede as they are too steeped in their ignorance